Dressed in the drama of high-powered calculations and powerful algorithms, the financial world spins on an axis all its own. The article, “Which Financial Institutions Primarily Serve Other Financial Institutions?” reveals the intricacies of this phenomenon. Imagine yourself as a player in this global board game, a matrix of transactions and dealings, where the product is monetary exchange. This exploration will guide you through the different financial institutions and highlight those that dedicate their services mainly to other monetary counterparts, operating in a tier of their own in this dynamic fiscal tapestry.

Understanding Financial Institutions

To tide the waves of the great financial sea, navigate the trade winds of the economy and unfurl the sails of your assets, it’s crucial to understand the gargantuan ocean liners that roam these waters, known as financial institutions.

Definition of Financial Institutions

When we say ‘financial institutions’, we are referring to establishments which conduct financial transactions such as investments, loans, and deposits. They are the lifeblood of our economy, feeding the financial needs of everyday businesses and individuals alike. Their existence ensures a constant circulation of funds, nourishing businesses, shaping economies and molding societies.

Importance of Financial Institutions

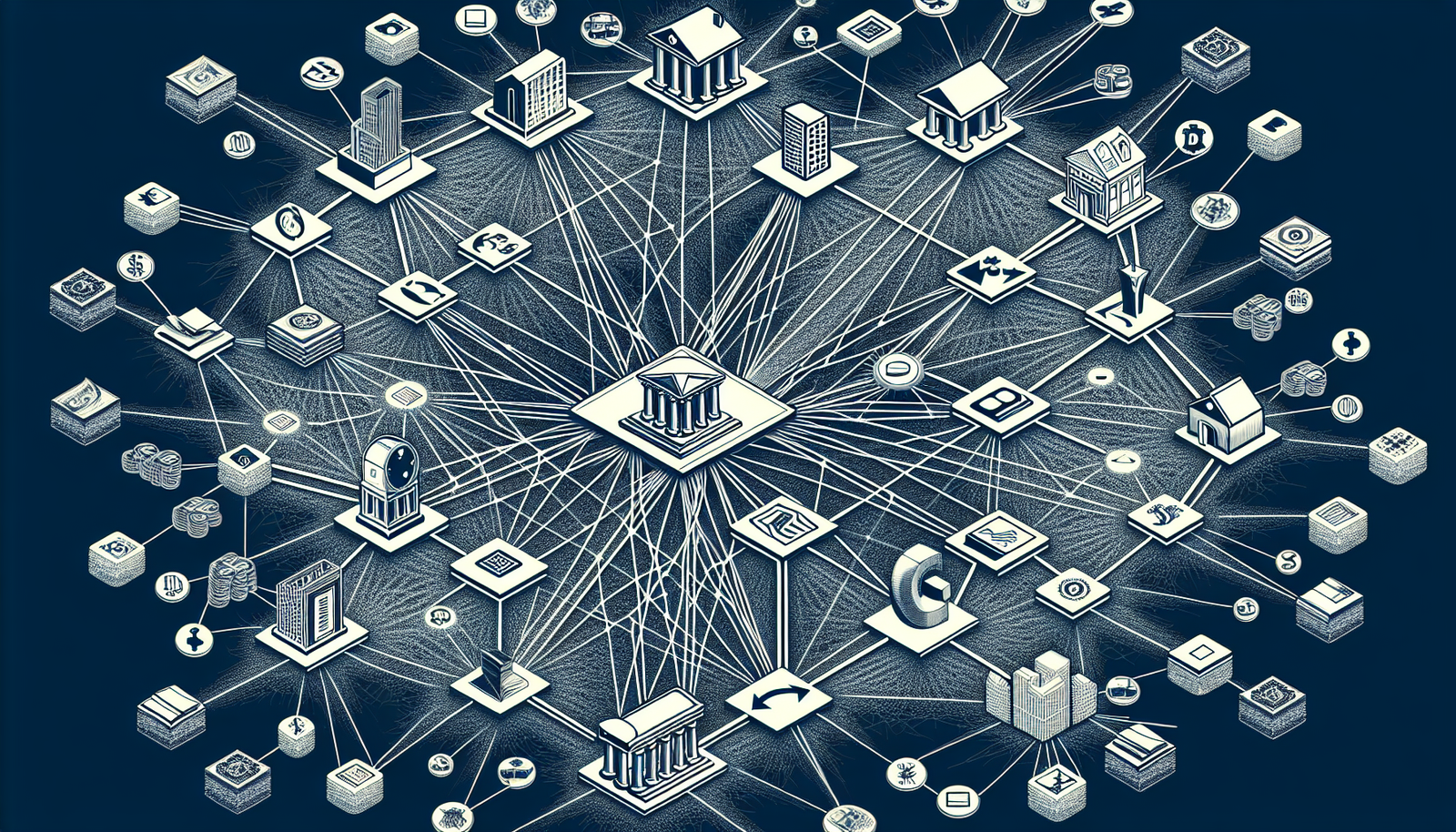

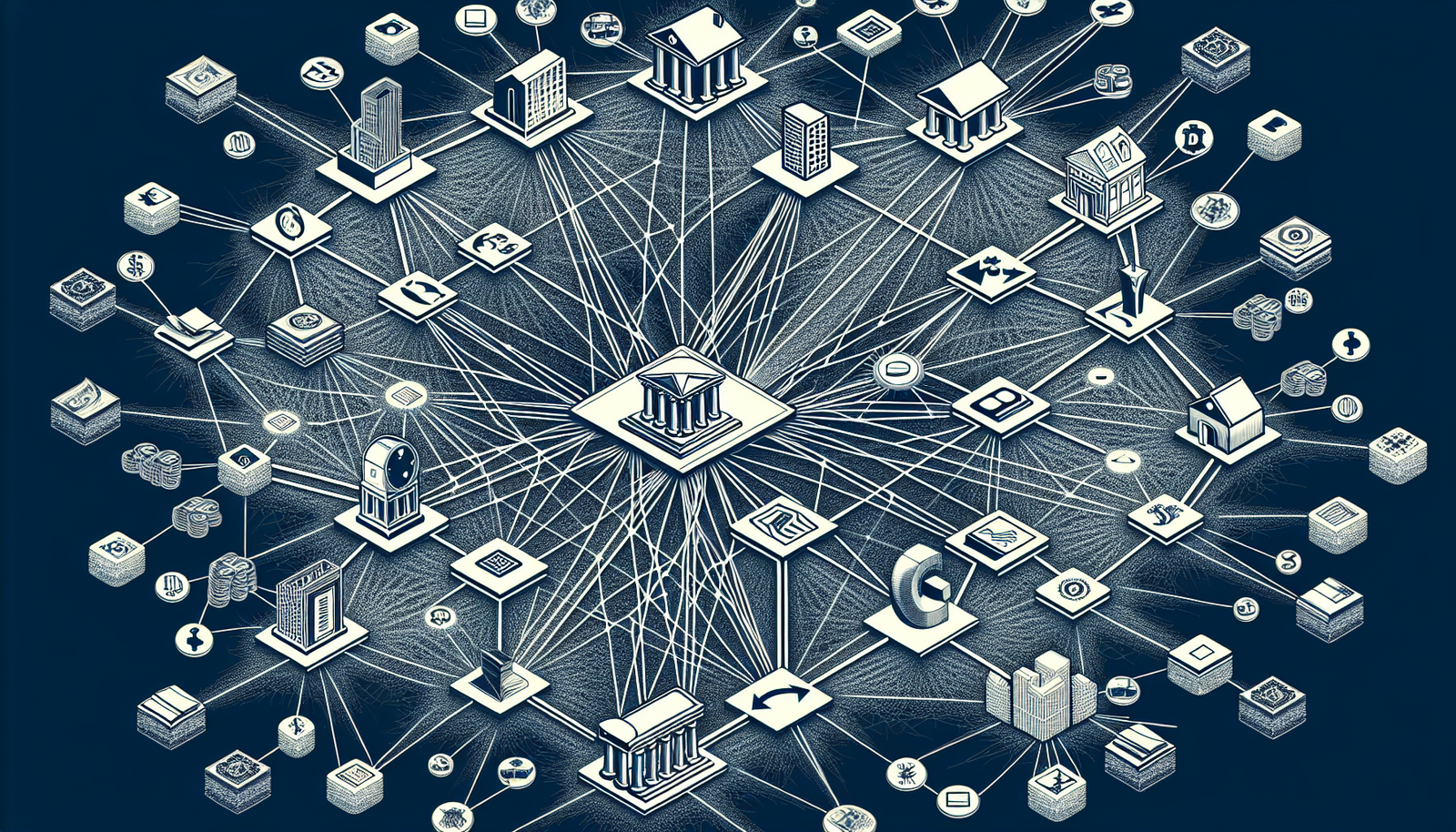

Do you remember playing Monopoly, the childhood game? Well, imagine what that would’ve been like without the bank. Yes, that mayhem of financial chaos is what our economy would be without financial institutions. They are the reservoirs of the economy, at the heart of almost every financial activity. They act as intermediaries in the financial system, serving as the bridge between people who have funds and those who need them. They foster economic development, facilitate transactions, distribute risks, and steer the direction of monetary policy.

Types of Financial Institutions

The mighty cadre of financial institutions is as varied and dynamic as the economies they serve. Each entity plays a unique role and offers distinct services. From the financial titans known as central banks to the great trade facilitators like security exchanges, each performs its duty in the grand ballet of the financial world.

Central Banks

Role of Central Banks

In the pantheon of financial institutions, none wields more power than the central bank. Like modern financial Zeus, central banks are the highest monetary authorities that set interest rates, control money supply, and manage inflation. They are the economic watchtower, overseeing and ensuring the stability and integrity of the monetary system.

How Central Banks Serve Other Financial Institutions

Do you know who acts as a bank to the banks themselves? Well, look no further, it’s the central bank. Central banks don the role of lender of last resort, providing funds to financial institutions during times of financial stress, ensuring the stability of the financial market.

Examples of Central Banks

Exemplary figures such as the Federal Reserve in the United States, the Bank of England in the UK, and the European Central Bank carry the title of central banks.

Investment Banks

Role of Investment Banks

The next performer on our stage is the investment bank. Imagine having a potent potion of money and ambition, but lacking the ingredients of knowledge and network to brew your desired success. Enter, investment banks. They are the wizards who transmute business dreams into reality, assisting companies in raising capital, providing advisory services, and doing securities trading.

How Investment Banks Serve Other Financial Institutions

Investment banks are like the rainmakers of money. They facilitate connections between investors and businesses, conducting Initial Public Offerings (IPOs) for companies to raise capital. They also provide other financial institutions with crucial services like asset management, risk management, and financial advisory.

Examples of Investment Banks

Prominent investment banks include titans such as Goldman Sachs, J.P. Morgan, and Morgan Stanley.

Commercial Banks

Role of Commercial Banks

Commercial banks are the everyday heroes of the financial system. They are the institutions where you deposit your funds, take out loans for your dream car or house, or open a line of credit for your business. Apart from these, they also offer a host of financial services like cash management, foreign currency exchange, and trade financing.

How Commercial Banks Serve Other Financial Institutions

Commercial banks serve other financial institutions by providing them with services like credit facilities, treasury services, and securities brokerage. They also act as a channel where these institutions can access funds deposited by the bank’s customers.

Examples of Commercial Banks

Commercial banking giants include institutions like Citibank, Bank of America, and HSBC.

Insurance Companies

Role of Insurance Companies

Insurance companies are the guardians against financial ruin, helping individuals and businesses manage risk. They provide policies that protect against various risks such as health emergencies, property damage, and business interruption.

How Insurance Companies Serve Other Financial Institutions

Insurance companies safeguard the financial health of other institutions by providing them with coverage against a range of potential losses. They also invest heavily in securities issued by these institutions, providing them with a source of capital.

Examples of Insurance Companies

Well-known guardians in the insurance sector include Prudential, Allstate, and MetLife.

Security Exchanges

Role of Security Exchanges

Stepping onto the financial stage next are the security exchanges, the bustling marketplaces where securities like stocks and bonds are bought and sold. They are platforms that allow companies to raise capital by issuing securities and investors to trade these securities.

How Security Exchanges Serve Other Financial Institutions

Security exchanges are arenas where financial institutions do battle. They provide a field for institutions to trade securities, offer prices for securities, and drive liquidity in the market. Through these exchanges, institutions can raise capital, manage risk, and grow wealth.

Examples of Security Exchanges

Famous arenas in this sector include the New York Stock Exchange (NYSE), London Stock Exchange (LSE), and the Tokyo Stock Exchange (TSE).

Clearing Houses

Role of Clearing Houses

Clearing houses play a vital role in ensuring the smooth processing of transactions. They act as an intermediary between buyers and sellers, mitigating the risk of default by either party. They ensure that every ‘i’ is dotted and ‘t’ crossed in the world of financial transactions.

How Clearing Houses Serve Other Financial Institutions

Clearing houses work behind the scenes to make transactions safer and more efficient for other financial institutions. They confirm trades, calculate obligations, and ensure delivery of securities, providing security and efficiency to financial transactions.

Examples of Clearing Houses

Key players in this sector include the Options Clearing Corporation, Euroclear, and Depository Trust & Clearing Corporation.

Rating Agencies

Role of Rating Agencies

Rating agencies are the ‘critics’ of the financial world. They analyze the creditworthiness of entities who borrow money, including governments, non-profit organizations, and corporations. They offer their ‘reviews’ in the form of ratings that guide investors about the credit risk associated with a bond, mutual fund, or other debt instruments.

How Rating Agencies Serve Other Financial Institutions

Other financial institutions rely heavily on the ratings provided by these agencies in making investment decisions. A high rating from an agency reassures lenders and investors about the safety of their investment or loan.

Examples of Rating Agencies

Major critics in this area include Moody’s, Standard & Poor’s, and Fitch Ratings.

Financial Market Intermediaries

Role of Financial Market Intermediaries

Financial Market Intermediaries, as their name suggests, are the intermediaries in the financial market. They serve as a conduit for the flow of funds from those who have surplus funds to those who need them. They include entities such as mutual funds, pension funds, and hedge funds.

How Financial Market Intermediaries Serve Other Financial Institutions

These intermediaries serve other financial institutions by pooling resources from individual investors and investing in a diverse range of securities. They provide these institutions with a ready market for the securities they issue, contributing to market liquidity.

Examples of Financial Market Intermediaries

Respected entities in this sector include Vanguard Group, BlackRock, and Bridgewater.

Conclusion

Recap of Financial Institutions Serving Other Financial Institutions

As you’ve seen, the financial ecosystem is intricately woven with each financial institution serving other institutions in unique ways. Central banks act as the lender of last resort, commercial banks offer credit facilities, investment banks orchestrate IPOs, while security exchanges facilitate trade, and it goes on.

Importance of These Interactions

These interactions are the gears that keep the financial machinery running smoothly. They facilitate risk management, liquidity, and capital formation, driving economic growth.

Future Predictions and Trend Analysis

As we sail into the future, the landscape of financial institutions is predicted to transform under the influence of trends like digitalization, environmental sustainability, and changing regulatory paradigms. Yet, irrespective of the form they take, these titans will continue to stride forth, shaping and reshaping the economy with every step.