Imagine walking into a bustling bank, the air buzzing with energy as countless transactions occur simultaneously. The world of finances may at times seem complex and incomprehensible. However, it essentially narrows down to three main types of bank transactions which define most of our banking interactions. In this article, you will learn about these primary banking maneuvers, which include deposits, withdrawals, and transfers. Understanding these crucial functions will empower you to navigate the financial seas with confidence and agility. This is your key to unlocking the mysteries of banking jargon.

Definition of Bank Transactions

Bank transactions – a term you encounter within the all-encompassing world of finance. But what does it truly mean? Picture this: you’re sitting in a quiet café, sipping on a latte, and you decide to send money to a friend for the concert ticket they bought you last week. The moment your fingers gracefully tap the ‘send payment’ button, you have partaken in a bank transaction – an economic action, a shift of funds, captured in the mysterious, virtual sphere of banking.

Understanding Bank Transactions

Digging a bit deeper, bank transactions fundamentally involve the movement of money. This can range from deposits to withdrawals, transfers to payments, and more. Think of bank transactions as financial conversations you’re carrying out with your bank, each involving an instruction for an activity with your money.

Importance of Bank Transactions

Bank transactions are life’s invisible operators; they silently facilitate our routines, keep economies thriving, and societies functioning. These transactions enable us to receive our salaries, buy groceries, pay rent, and so much more. Without them, our financial world would grind to a halt, leaving us stranded in an ocean of impossibility.

The Three Main Types of Bank Transactions

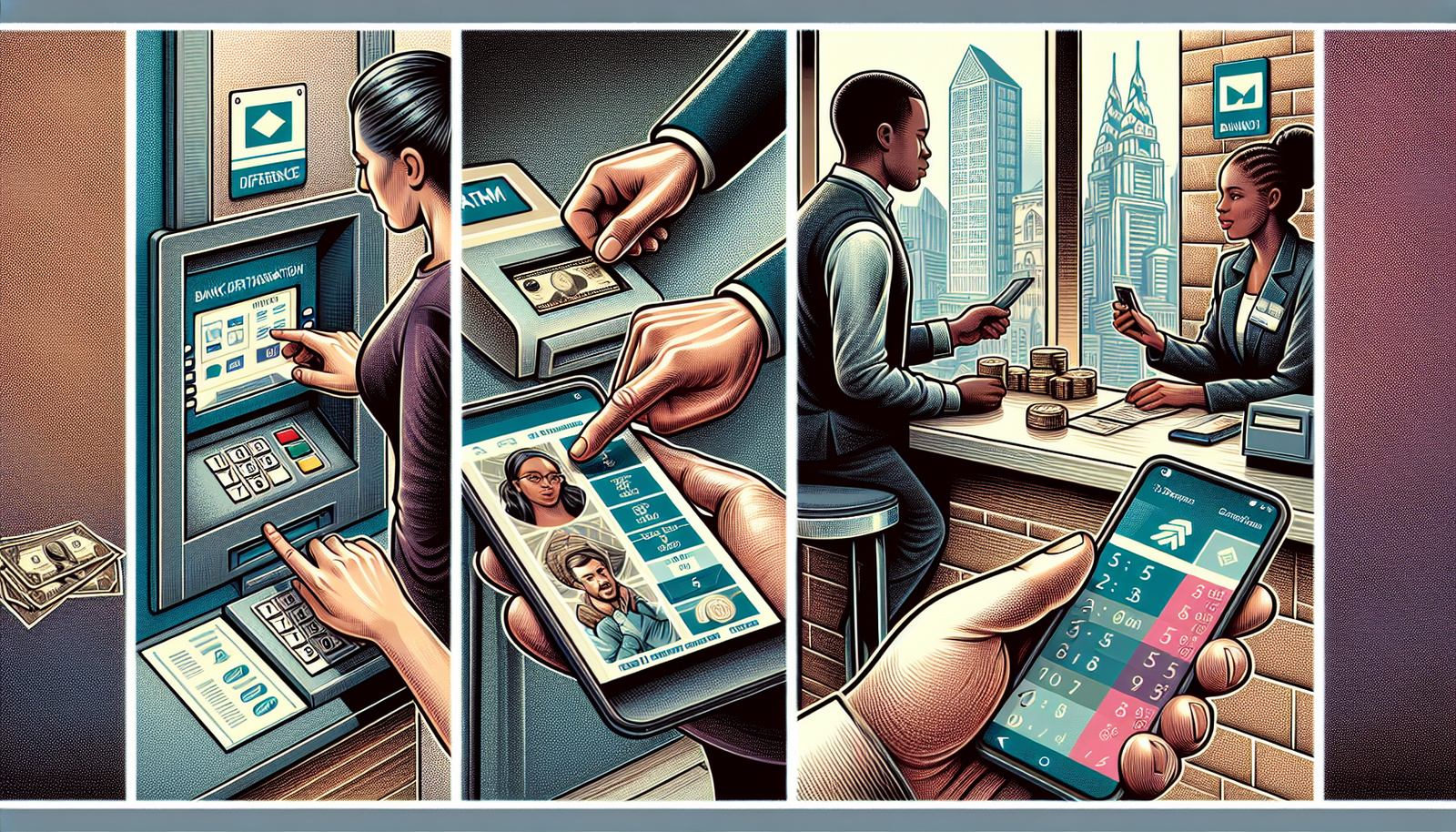

Intricately woven into our everyday activities are three main types of bank transactions: deposits, withdrawals, and transfers. They are the backbone of any bank transaction, each serving a distinct, yet intertwined, purpose.

Overview of the Three Major Transactions

Let us demystify these types: Deposit transactions are financial contributions to your account; this could be your paycheck arriving or a friend reimbursing you for dinner. Withdrawal transactions signify the removal of funds from your account, be it through an ATM or during online shopping. Transfer transactions bridge the gap between two accounts, facilitating the movement of money.

Role of These Transactions in Everyday Banking

These fundamental transactions encompass nearly all of our daily banking operations. They support the exchange of money, from maintaining your savings to meeting our spending needs. Utterly indispensable, they shape the dynamics of our financial lives.

Deposit Transactions

Sailing into the waters of deposit transactions, we find ourselves introduced to a realm where money flows into your account.

Meaning of Deposit Transactions

Deposit transactions are simply instances where funds are added to your bank account. They are the financial handshakes you initiate or receive, signaling an increase in your account balance.

Types of Deposit Transactions: Cash, Checks, and Electronic Transfers

The means through which deposits materialize encompass cash, checks, and electronic transfers. Cash deposits occur when you physically visit your bank and add money to your account. Check deposits refer to the process where you deposit a check given to you, resulting in an increase in your account balance once processed. Lastly, electronic transfers are seamless digital migrations of money to your account from another.

Factors Affecting Deposit Transactions

Like a dance, deposit transactions can be affected by various factors. These include clearing times for checks and limits on cash deposits for certain accounts. Understanding these nuances can aid in smooth financial navigation.

Withdrawal Transactions

We now descend into the realm of withdrawal transactions – instances that lead to the reduction of your bank account balance.

Definition of Withdrawal Transactions

A withdrawal transaction occurs when you remove funds from your bank account. Every ice cream you buy or bill you pay triggers a withdrawal transaction, taking money from your haven of finances.

Types of Withdrawal Transactions: Cash Withdrawals, Debit Card Purchases, and Wire Transfers

Withdrawals can come in many forms – cash withdrawals, debit card purchases, and wire transfers. Cash withdrawals happen when you visit an ATM or branch, physically extracting money. Debit card purchases are electronic withdrawals made during payments at Point of Sale or online, and wire transfers are the digital journeys your money embarks on, leaving your account.

Understanding Withdrawal Limits

Withdrawing freely from your account sounds appealing, but banks often set withdrawal limits to ensure account security. Recognizing these constraints helps to plan your spending effectively.

Transfer Transactions

Driving into the digital highway of transfer transactions, we observe money shifting between accounts.

Understanding Transfer Transactions

Simply put, transfer transactions involve moving funds from one account to another. These transactions occur within the same bank or different institutions, connecting accounts across financial landscapes.

Difference Between Internal and External Transfer Transactions

The difference lies within their reach – internal transfers occur within the same bank, while external transfers cross over to other banks. Both cater to our need for flexible money movement, supporting our diverse financial engagements.

Significance of Transfer Transactions in Today’s Digital World

In our age of hyper-connectivity, transfer transactions form the digital arteries for our financial health. They connect us to our loved ones, assist in business transactions, and power online shopping experiences. Owing to their significance, they are integral to our digital lives.

Mechanism of Bank Transactions

Bank transactions, as fascinating as they are, revolve around certain mechanisms that ensure smooth, efficient operations.

Working of Bank Transactions

At a basic level, bank transactions involve debiting one account and crediting another, facilitated by a complex network of banking systems. These systems record, process, and validate every transaction, keeping a watchful eye on our financial activities.

Role of Banks in Facilitating Transactions

Banks flawlessly execute your financial instructions, acting as both your accountant and gatekeeper. They are guardians, managing your transactions while ensuring security and compliance with financial regulations.

Understanding the Transaction Cycle

The transaction cycle refers to the process from initiation to completion of a bank transaction. It begins with your financial instruction, goes through verification and processing stages, and concludes with the execution of the transaction. It is the behind-the-scenes play orchestrating your banking activities.

Security Factors in Bank Transactions

Security is paramount in bank transactions, continually evolving to protect us in an increasingly digital world.

Need for Security in Bank Transactions

Bank transactions require robust security to protect your hard-earned money. Enhanced security measures uphold trust, an essential element in our relationship with our banks.

Typical Security Measures Implemented by Banks

Banks often employ a mix of password protections, two-factor authentication, encryption, and more to safeguard transactions. Advanced technologies such as biometrics and AI are also becoming commonplace, raising the security bar even higher.

Dealing with Unauthorized Transactions

Despite stringent measures, unauthorized transactions do occur. Banks generally have procedures to handle such situations, including transaction reversal and recompense. Stay vigilant, for awareness is the first line of defense.

Cost Implications of Bank Transactions

Despite their importance, bank transactions can have cost implications, with fees and charges often making surprise appearances.

Bank Fees Associated with Different Transactions

Banks occasionally charge fees for specific transactions. These fees can be for ATM withdrawals, wire transfers, or even check issuances. Being mindful of these can save you from unnecessary financial strain.

Understanding Overdraft and Non-sufficient Funds Fees

Overdraft and non-sufficient funds fees manifest when you don’t have enough money for a transaction. Banks typically charge these fees when they cover the shortfall or decline the transaction to save you from financial embarrassment.

How to Minimize Transaction Costs

Costs can be minimized by being aware of your bank’s fee structure, maintaining required balances, and using your bank’s ATMs and services. Choosing a bank that aligns with your financial habits can also go a long way in minimising transaction costs.

Impact of Technological Innovation on Bank Transactions

Technological innovation has fundamentally revolutionized bank transactions, steering them towards a more digital, inclusive future.

Digital Transformation of Banking Sector

The advent of technology has spearheaded a dynamic shift in the banking sector. Automation, digitization, and personalization have become the norm, making banking more accessible and convenient.

Mobile Banking and Online Transactions

Mobile banking and online transactions allow us to bank virtually anytime, anywhere. They have provided buckloads of convenience, making transactions as easy as a few taps on your phone.

Fintech and Its Influence on Traditional Banking

Fintech startups have brought about substantial innovation and competition to traditional banking. They’ve brought forth new transactional experiences, disrupting age-old banking norms and pushing the boundaries of traditional banking.

Future Trends in Bank Transactions

The future of bank transactions seems as exciting as it is intriguing. Emerging trends and novel technologies hint at a fascinating financial future.

Emerging Trends in Banking Sector

Breakthrough technologies, like Artificial Intelligence, Blockchain, and Predictive Analytics are shaping the banking scene. They promise to deliver smarter, safer, and faster transactions.

Impact of Blockchain and Cryptocurrency

In the realm of banking, Blockchain can potentially revolutionize how transactions are processed and validated. Coupled with cryptocurrencies, they offer state-of-the-art security and an opportunity to further streamline and hasten transactions.

The Future of Cash Transactions

The future of cash transactions is contentious. Amidst the digital revolution, cash transactions are amphibi in the financial evolution—still widely used, yet gradually shrinking in significance relative to the rise of digital payments. As we continue the journey towards an increasingly interconnected world, only time will tell how these transactions will evolve.

Leave a Reply