It’s a question that’s danced through your mind more than once: “How much can a bank loan out?” Perhaps you’ve gazed at grand mansions and luxurious yachts and wondered, “How can someone possibly afford that?” Grab a cup of coffee, sit back, and prepare to immerse yourself in the intricate, often misunderstood world of banking. In the following text, you’ll unravel the captivating secrets and codes of banking, discovering exactly how and why banks can afford to loan out the colossal amounts they do. That mansion and yacht might not be unfeasible after all!

Understanding the Concept of Bank Loans

Bank loans form the very core of modern economies, fueling businesses, dreams, and ambitions. They are tools of financial growth and prosperity for individuals and corporations alike. Through bank loans, you can finance a plethora of needs – ranging from personal ones like higher education, to business ones like expanding your company.

Basic definition of a bank loan

Picture this – you are a bank, and a customer comes to you with a need for financial assistance. Here’s where a bank loan comes into play. A bank loan is an amount of money lent from a bank to a customer, which needs to be repaid over a stipulated period of time, along with interest. It’s the bread and butter of a bank’s business model – lend money, earn interest.

Different types of bank loans

And just like the many needs of your customers, you offer a variety of loans. Personal loans for individual needs, mortgage loans for homeowners, auto loans for vehicle purchases, student loans for higher education, business loans for companies – each tailored for specific purposes.

How bank loans operate

Simply put, when you lend money as a bank, you’re engaging in a contractual agreement. You loan out the money under specific terms and conditions, established beforehand. These include interests rates, loan repayment period, and penalties for default. These terms are determined by various factors including the type of loan, the borrower’s creditworthiness, and market rates.

The Role of the Federal Reserve in Bank Lending

The banking universe doesn’t function independently. It’s part of a larger financial system, with the Federal Reserve playing a crucial role.

Interaction between banks and the Federal Reserve

As a bank, your relationship with the Federal Reserve is akin to that of a customer with you. Banks borrow money from the Federal Reserve in times of need, with the Federal Reserve being the lender of last resort. The key factor of this relationship is the federal funds rate – the interest you pay them.

The Federal Reserve’s effect on loans

The Federal Reserve influences your lending practices heavily. When they lower the federal funds rate, you can borrow money cheaper, encouraging you to lend more. If they raise the rate, borrowing becomes expensive for you, discouraging lending.

The Federal Reserve’s role in controlling lending norms

The Federal Reserve also helps you maintain monetary stability by controlling lending norms. They set reserve requirements, monitoring the amount of money you keep in reserve, thus ensuring you have the ability to meet unexpected withdrawals.

Factors Determining the Amount a Bank Can Loan Out

How much can a bank lend out? Quite simply, it depends.

Importance of the bank’s capital holdings

Your capital is something akin to a financial cushion. The more capital you possess, the greater your ability to lend since it helps absorb losses.

Effect of customer deposits on loan amounts

Deposits from your customers form a significant portion of your loanable funds. The more deposits you have, the higher your lending capacity.

Influence of the economic environment on loans

The economy’s earrings also affect how much you can lend out. During a boom, with high demand for loans and lower default risks, you lend more. Conversely, during a slump, lending decreases.

Impact of a bank’s creditworthiness and financial stability

Your financial health and creditworthiness also dictate your lending capacity. The more financially stable and creditworthy you are, the higher the trust and the ability to lend.

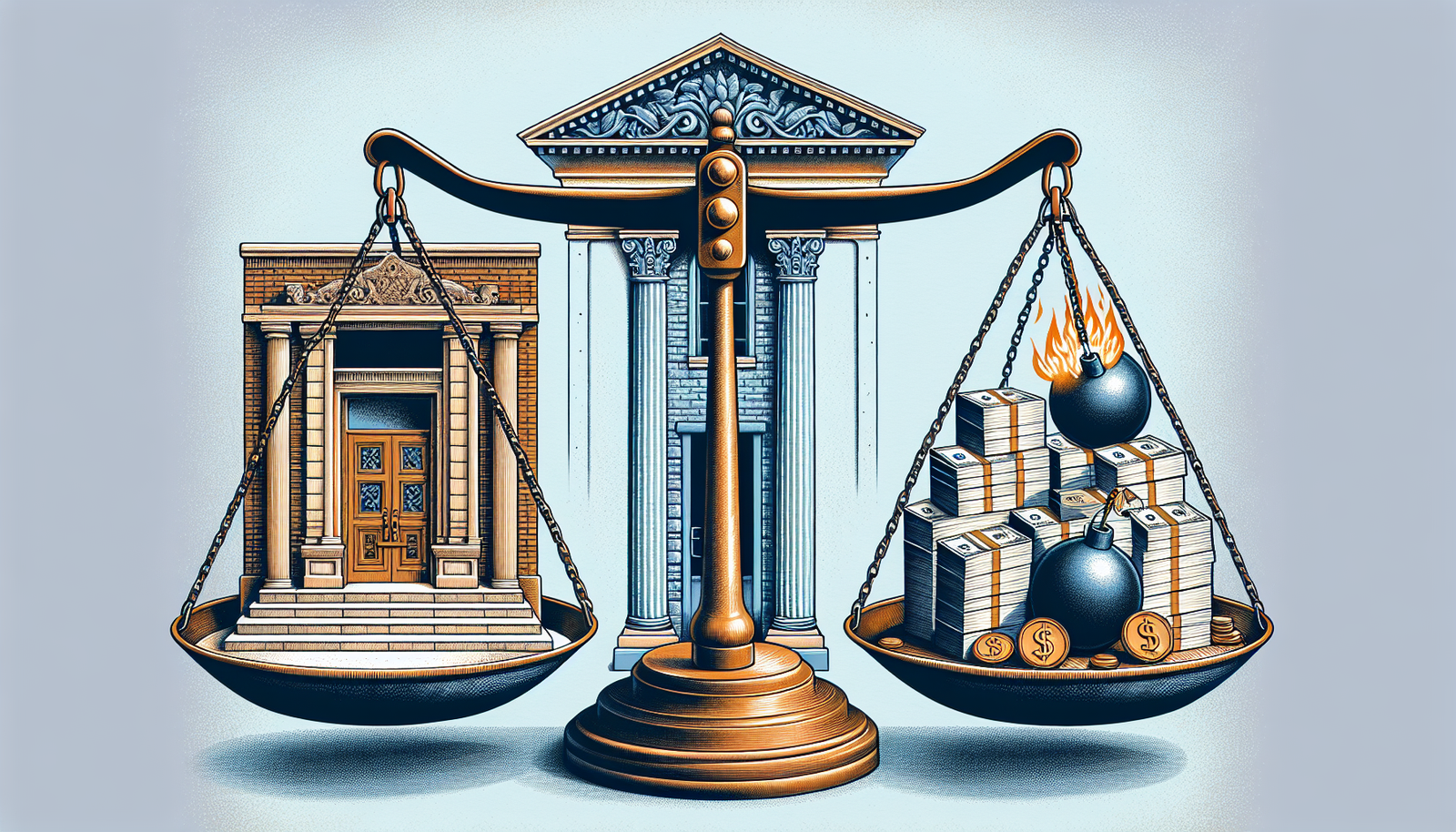

Understanding the Fractional Reserve System

Think of this as your monetary magic trick.

The basic principles of the fractional reserve system

Under the fractional reserve system, you don’t need to keep all your customer deposits in reserve. Instead, you retain a fraction and lend out the rest. It’s how you create money out of thin air.

How the fractional reserve system impacts bank loans

The system directly impacts your lending capability. The larger the fraction you’re required to hold, the less you can lend out.

The fractional reserve ratio and its significance

The reserve ratio – the fraction you hold as reserves – is vital. It affects the money multiplier and consequently, the overall money supply in the economy.

Impact of Regulations on Bank Lending

In this game of lending, regulations are the rulebook.

The role of banking regulations in lending

Banking regulations guide your lending practices, ensuring economic stability. They set lending standards, determining who qualifies for loans, under what terms, and how much can be lent.

How regulatory changes can affect loan amounts

Changes in these regulations can significantly impact your lending. For instance, easing regulations may allow you to lend more, while stricter rules might curtail lending.

Specific regulations affecting banking loans

Specific regulations like capital requirements, reserve ratios, and credit rules can greatly influence your lending practices.

Risk Management and Bank Loans

Juggling lending and risk is a tightrope walk.

The significance of risk management in banking

Risk management is your safety net – it helps you assess, control, and minimize risk associated with lending.

Risk assessment in loan approval

Risk assessment in loan approval determines whether it’s wise to lend to a particular customer. After all, everyone isn’t a trustworthy borrower.

Measures taken by banks to minimize loan default risk

Ensuring loan repayment is crucial. Hence, you undertake many measures like credit checks, collateral requirements, and setting loan covenants to minimize default risk.

Role of Bank Size in Lending Capacity

Small or large – size does matter in banking.

Variation in loan capabilities between large and small banks

Each bank’s lending capacities vary depending on their size. Larger banks tend to have a higher lending capacity due to larger capital and more diversified portfolios compared to smaller banks.

Why bank size can influence loan amounts

With a larger capital base and more diversified portfolios, bigger banks can spread their risks better making them more resilient in the face of economic downturns, and thus, enabling them more room to dole out loans.

The role of diversified portfolios in a bank’s lending capacity

Diversified portfolios are a key factor in a bank’s lending capacity. By spreading investments across various sectors, asset classes and geographical region, banks spread the risk of losses, thereby maintaining a stable capital base.

Influence of Economic Conditions on Bank Loans

Like any other business, banking too is influenced by the economic conditions.

The effect of economic cycles on loans

In phases of economic boom, you may see a surge in loan demands due to favourable conditions for businesses and individuals. On the flip side, during recessions, the demands for loans may shrink, as businesses and individuals cut back their borrowing due to uncertainty.

How loans can reflect economic health

The health of your loan portfolio can be an indicator of the overall health of the economy. In periods of economic growth, loan defaults typically decline. In times of economic downturns, loan defaults often rise as businesses and individuals struggle to make their payments.

Impact of economic downturns on lending

During economic downturns, you may adopt a cautious stance on lending as your risk tolerance lowers. The uncertainty surrounding borrower’s ability to repay the loans may lead to tightening of lending norms.

The Role of Creditworthiness in Bank Lending

As a bank, gauging the creditworthiness of your borrowers is a pivotal part of your lending process.

How banks assess borrower creditworthiness

To assess the borrower’s creditworthiness, you dig into their financial history, review credit scores, evaluate their capacity to repay the loan along with taking into consideration their character and general economic conditions. This multi-faceted evaluation helps you to map out the risk of lending to the borrower.

Creditworthiness as a factor in the loan approval process

Creditworthiness is pivotal in deciding if a loan should be approved. Poor creditworthiness could lead to loan denial, while solid creditworthiness could result in approval of the loan at favourable terms.

How poor creditworthiness can limit loan access

A borrower with poor credit history may find it challenging to secure a loan. Even if the loan is approved, the borrower may have to contend with higher interest rates and stringent conditions as a means to mitigate the risk taken by you as a bank.

The Future of Bank Lending

Bank lending, like any other sector, is swaying with the winds of change and innovation.

Emerging trends in banking loans

Rise of digital banks, increased use of data analytics for risk assessment, and growing adoption of blockchain technology are some emerging trends transforming the landscape of bank lending.

How technological developments can influence bank lending

Advancements in technology are fast transforming the banking sector. Fintech innovations, artificial intelligence, machine learning and big data are playing significant roles in risk assessment, credit scoring, enhancing security measures and improving customer service.

Potential challenges and opportunities in bank lending

While technology brings in innumerable opportunities, it also brings challenges. Cybersecurity risks, maintaining regulatory compliance in an evolving landscape and managing customer data are some concerns. On the other hand, reaching to unbanked populations, integrating with the fintech ecosystem and leveraging advanced analytics offer massive growth potential. Poised on this pivotal juncture of change, remains the question: how much can a bank lend out in the face of tomorrow’s opportunities and challenges? The answer, like the tapestry of banking itself, remains a complex weave of various elements.

Leave a Reply