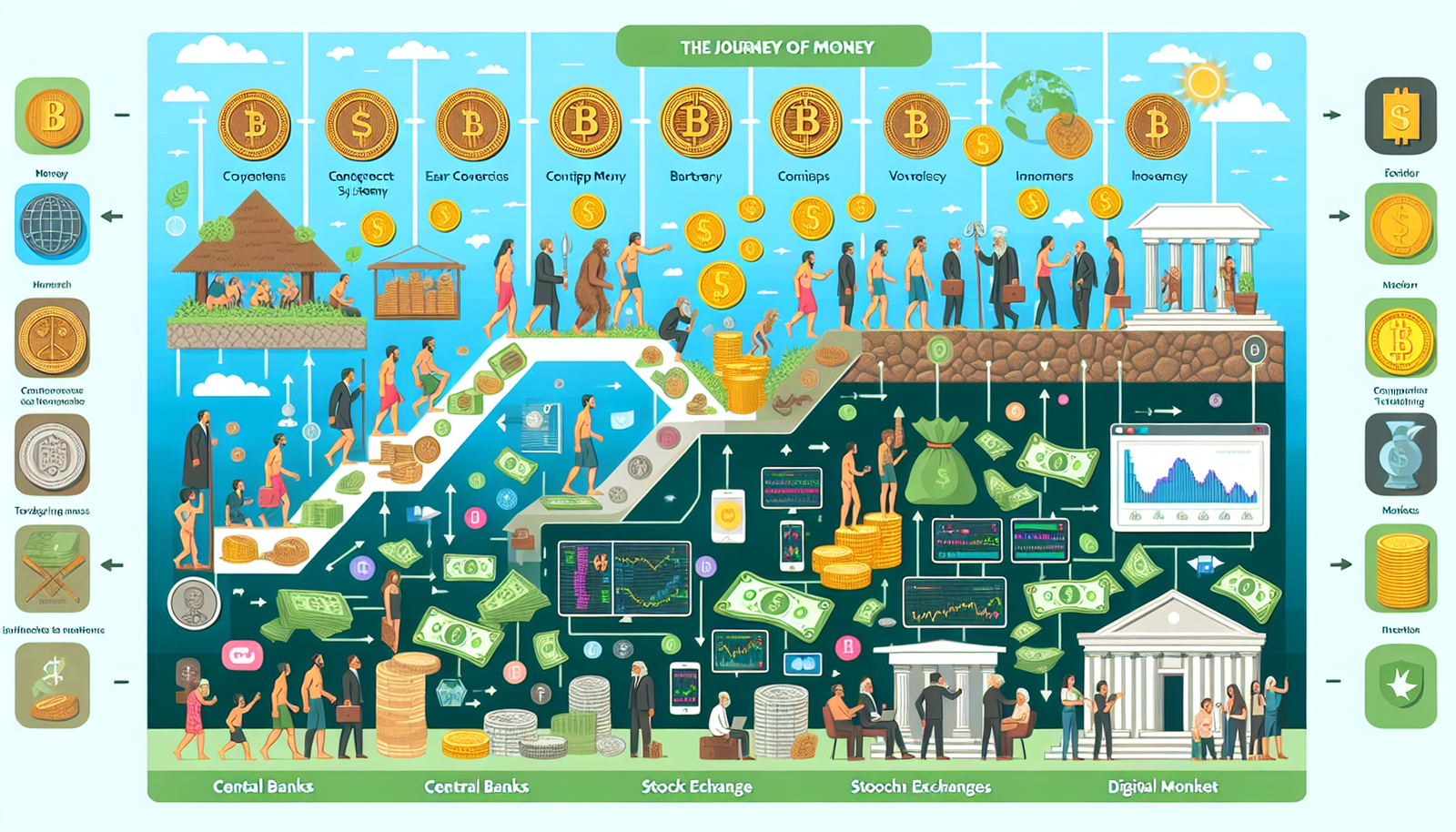

Imagine yourself on a journey, a quest to uncover the mystifying world of money. From your pockets to your bank account, from the cash counter to the Wall Street, “How Does Money Work” is the ultimate guide that demystifies the complexities of the economic world. No jargon, no complications, just plain and simple understanding of how the notes and coins that we see and use every day can hold so much importance and power. So, prepare yourself for an enlightening expedition that unveils the profound mechanisms behind your transactions, investments, and savings.

Origins of Money

The roots of money, as you know it today, lie in a system as ancient and fundamental as civilization itself. It’s fascinating to trace the journey of the concept and manifestation of money from the dawn of civilization to the present digital age.

Barter System

In the beginning, there was the barter system. The barter system was a system of trading in which goods or services were directly exchanged for other goods or services without a common unit of exchange in between. You might have a bushel of grain, and in exchange for that grain, you might receive a number of pots from the potter in your village. Despite its simplicity, this system had its flaws. The main issue was establishing a standard measure of value for vastly different items and commodities for barter. It was also essential for a coincidence of wants to exist, a situation where the needs of two individuals aligned perfectly for a successful trade.

Introduction of Currency

The hurdles posed by the barter system led to the advent of currency. Precious metals, particularly gold and silver, became the preferred form of currency due to their acceptability, divisibility, durability, and rarity. These metals were often shaped into coins, with their value typically determined by their weight. Coins became the language of commerce, a universal medium of exchange, eradicating the problem of the coincidence of wants and subjectivity in the barter system.

Development of Paper Money

Lugging around bags of coins wasn’t practical, hence paving the way for the innovation of paper money. You can trace the roots of paper money back to promissory notes issued by goldsmiths in the Middle Ages. These notes were printed guarantees, affirming to pay the bearer a certain amount of metal on demand. Over time, these notes started acting as a medium of exchange, and hence, paper money was born.

Evolution to Digital Money

Then came the age of electronic transactions and digital money, making your life easier than ever before. The immaterial form of currency allowed for the instant and effortless transfer of funds across the world. Today, money is largely a matter of binary sequences in a computer network and is slowly transitioning from physical to entirely digital.

Types of Money

As you’ve seen, money comes in many forms. Its meaning has evolved throughout centuries, and so have its varieties and types.

Commodity Money

Initially, money took the form of a commodity, gold or grain, things which held intrinsic value. Commodity money derives its value from the commodity it is made of. This was the first step in moving away from the barter system.

Representative Money

It then transformed into representative money, which is an item such as a token or piece of paper that has no intrinsic value. Its worth is derived from the promise by the issuer that it can be exchanged for a set amount of a valuable commodity, like gold.

Fiat Money

Money then evolved into what’s known as fiat money. This is the money you’re the most familiar with today. It’s not backed by a physical commodity but by the trust and confidence users have in the economy of the country issuing this money. The value of fiat money lies in the faith and credit of the economy.

Cryptocurrency

The latest evolution in the arsenal of money is cryptocurrency. Cryptocurrencies like Bitcoin and Ethereum function on a decentralized digital platform called blockchain. They are unregulated and are immune to governmental control. Their value is not tethered to any commodity or any country’s economy.

Money Creation

The process of money creation is an intriguing one. Here’s how it works in today’s monetary system.

Role of Central Banks

The primary role in money creation is played by the central bank of a country. They control the nation’s money supply, set interest rates, and implement monetary policies. They print physical currency and mint coins. But more importantly, they control the amount of digital money by lending money to commercial banks at a predetermined interest rate.

The Money Multiplier

The money multiplier is a mechanism by which the banking system creates more money than what is initially deposited. Banks are required to keep only a fraction of the money they receive as deposits and lend out the rest. When this loaned-out money is redeposited in banks, it creates new deposits, therefore, creating more money. This cycle keeps repeating, multiplying the initial amount of money many times over.

Quantitative Easing

Quantitative easing (QE) is a measure taken by central banks to inject money into their economy. Under QE, central banks buy government bonds or other financial assets to increase the money supply and encourage lending and investment.

Digitization of Money Creation

With the rise of the digital era, the creation of money has also digitized. Central banks can now create electronic money by crediting the accounts of commercial banks, which then enters the economy through loans and credits to individuals and businesses.

The Money Supply

Money exists in several forms, and all of these forms combined constitute the money supply.

Definitions of Money (M0, M1, M2, M3)

In the simplest terms, money supply can be categorized into four types – M0, M1, M2, and M3. M0 represents physical money (coins and notes), checks, and central bank’s reserves. M1 includes M0 and demand deposits like checking accounts. M2 consists of M1, savings accounts, and small-time deposits. M3 includes all of the previously mentioned types and large time deposits, institutional money market funds, and other larger liquid assets.

Controlling the Money Supply

Central banks manage the money supply by conducting open market operations, changing interest rates, and adjusting reserve requirements. This control is crucial to maintain economic stability and combat inflation or deflation.

Impacts on Inflation and Deflation

Changes in the money supply can have significant impacts on the economy. Excessive money supply can lead to inflation, where the value of money falls, and the general level of prices rises. On the other hand, a reduction in the money supply can cause deflation, characterized by falling prices and increased value of money.

Modern Money Theory

Modern Money Theory (MMT) is a heterodox economic theory that describes currency as a public monopoly. According to MMT, the government that issues its own currency can spend freely as it can never run out of money. This theory offers a new perspective on fiscal policy, national debt, and inflation.

Role of Banks in the Money System

While central banks control and regulate the money supply at a macro level, it’s the commercial banks that interact directly with the public.

Banks as Financial Intermediaries

Banks serve as the cornerstone for transactions in the economy. They are financial intermediaries which accept deposits from those with surplus money and lend it to those in need of money. They bridge the gap between savers and borrowers, keeping the wheel of the economy spinning.

Fractional Reserve Banking

The power of banks to create money stems from a system called fractional reserve banking. Banks are required to keep only a fraction of their total deposits in reserve for withdrawal requests. The rest can be loaned out, thus creating more money in the system and earning interest on it.

Credit Creation

Credit creation refers to the unique ability of banks to multiply loans and deposits through the incremental lending and depositing throughout the system. This mechanism considerably expands the money supply and provides an influx of credit in the economy.

Role in the Economy

Banks play a paramount role in shaping the economy. Through lending and investing, they spur economic growth, fuel job creation, and service the financial needs of individuals, businesses, and governments.

Exchange Rates

Every currency carries value, and this value fluctuates in relation to other currencies. This is precisely where the concept of exchange rates steps in.

Definition and Roles of Exchange Rates

Exchange rates denote the value of one currency in terms of another. They play an instrumental role in facilitating international trade, determining the economic health of a country, and indicating investment opportunities across borders.

Determinants of Exchange Rates

Various factors determine exchange rates, including interest rates, inflation rates, political stability, economic performance, and speculations in the international financial market.

Floating Versus Fixed Exchange Rates

Exchange rates can be broadly classified into a floating and a fixed system. A floating rate varies freely and is driven by the global forex market. In contrast, a fixed rate is pegged to another currency or a basket of currencies and maintained by the country’s central bank.

Impacts on the Economy and Trade

Fluctuations in exchange rates impact the economy and international trade significantly. It influences the cost of imports and exports, investment incentives, and tourism. The right balance in exchange rates is essential for fostering economic growth and stability.

Inflation and Deflation

Price stability is a significant concern for any economy, and maintaining the right balance is crucial. Inflation and deflation, both extremes of price instability, can cripple economies.

Definitions and Causes of Inflation and Deflation

Inflation refers to a sustained increase in general price levels over time, which erodes the purchasing power of money. Deflation, on the other hand, signifies a decline in these prices. The causes of inflation and deflation vary, generally revolving around the relationship between supply and demand of goods and services and the money supply.

Impacts on Economy

Inflation and deflation impact the economy significantly. While moderate inflation is seen as a sign of a healthy economy, hyperinflation can erode savings and hinder economic growth. Deflation, while it sounds beneficial, can lead to a decrease in consumer demand and an overall slowdown of the economy.

Measuring Inflation and Deflation

Inflation and deflation are typically measured using indexes such as the Consumer Price Index (CPI) or the Wholesale Price Index (WPI). These indexes track the prices of a basket of common goods and services over time.

Policy responses

In response to inflation or deflation, central banks use monetary policy tools. They can adjust interest rates, change reserve requirements, and conduct open market operations. The government can also use fiscal policies, such as adjusting taxation or government spending.

Money and Debt

The relationship between money and debt is interlocked. It’s paramount to understand this relationship to grasp many economic concepts.

The Relationship between Money and Debt

Every act of money creation now involves the creation of debt. Banks create money by lending out more than they hold in reserves. This money becomes debt for the borrower, and an asset for the bank. Therefore, the majority of the money in circulation is essentially debt.

Debt Cycles

Debt cycles refer to the fluctuations that occur in the overall indebtedness of consumers over time. These cycles can have significant implications on the economy, leading to periods of economic expansion and contraction.

Sovereign Debt and Default

Sovereign debt is the debt owed by a government to its lenders. A country might default on its debt if it fails to make payments on time. This sovereign debt default can reflect negatively on a country’s economic stability and creditworthiness.

Consumer Debt

Consumer debt refers to the debt taken on by individuals rather than governments. This includes mortgages, auto loans, student loans, and credit card debt. The accumulation of excessive consumer debt can lead to a debt crisis, affecting economic stability.

Impact of Money on Society

Money has become the yardstick to measure almost everything in today’s society. Its influence extends well beyond the economy into social fabric.

Wealth and Income Inequality

Money, and the distribution of it, plays a significant role in wealth and income inequality. A resounding disparity in wealth distribution often indicates societal inequality, giving rise to many socio-economic issues.

The Impact on Economic Growth

Money powers economic growth. It facilitates trade, and accumulating money enables investment, leading to capital formation and economic development. However, the concentration of wealth in few hands can hinder this growth potential.

Relationship with Happiness and Well-being

There’s a nuanced relationship between money and happiness. While money can guarantee comfort and security, it doesn’t necessarily guarantee happiness. However, a baseline level of financial security is necessary for happiness and well-being in today’s material world.

The Future of Money and Society

The future holds the potential for further evolution of money, especially in terms of digital currencies and cashless societies. These shifts could significantly impact societal structures, reshaping power dynamics and systems of exchange.

Future of Money

The future of money is being written before our very eyes. Technology is evolving rapidly, sparking impressive advancements in the world of finance.

Digital and Cryptocurrencies

Digital currencies and cryptocurrencies are the new age of money. Backed by secure technology and convenience, they promise to revolutionize the future of transactions.

The Role of Blockchain

Blockchain technology, the foundation of cryptocurrencies, has the potential to transform the future of money. It provides a secure and transparent platform for transactions, eliminating the need for intermediaries and reducing transaction costs.

Potential End of Cash

With the rapid digitalization of money, the end of physical cash might be nearer than initially anticipated. Money is progressively becoming an abstract concept, reshaping the way you transact, save, and think about value and trust.

Implications for Banks and Government

The potential end of cash and the rise of digital currencies present considerable implications for banks and governmental bodies. Digitization may redefine their role, demand new regulations and policies, and challenge the traditional notion of monetary sovereignty. The future of money is a journey, and it’s one that promises to redefine the concept of money as you know it today.

Leave a Reply