Sailing on the sea of modern economics, you may stumble upon a curious question that tickles your financial intellect – “Do banks loan deposits?”. This article sets same question as its central venture buoy. It takes you on an enlightening journey, full of fiscal insights and credible references, to unravel the layered mystery behind this crucial query. Let your curiosity guide you as the curtain is uplifted on the stage of banking actions and their impact on the customer’s deposits. With vivid elucidations and logical reasoning, your perception of the banking world is about to take a turn towards knowledge packed enlightenment.

Understanding the Banking System

Banks, those empires of commodity and finance, are much more than mere keepers of our earnings. As you encounter the banking system, it becomes vivid that it weaves an intricate web of multi-faceted functions and core principles that determine the course of economic stability and growth.

Fundamental Concepts of Banking

Within the labyrinth of banking, you’ll come across the foundational principles that shapes its structure. Primarily, banks are intermediaries that safeguard the wealth of the public, indulge in lending activities and promote money flow in the economy. Furthermore, they are responsible for maintaining financial equilibrium, controlling interest rates, and to a great extent, shaping governmental economic policies.

Role and Functions of Banks

As you dive deeper into the realms of banking, realize the versatile roles banks play in our financial lives. Banks undertake the role of a custodian, investment advisor, and lender. It’s through these functions you’re able to save, invest, borrow and even pay your bills. Additionally, banks fuel economic growth by extending credit to businesses and individuals, thus facilitating expansion and expenditure.

Deposits in Banking

Definition of Deposits

Deviating away from the sheer anonymity of cash under your mattress, deposits in banks are named accounts where your monetary assets are held securely. They hold importance as banks rely on these reserves to carry out lending activities.

Types of Deposits

In your encounter with banking, you’ll note that it provides a plethora of deposit options to meet your varied financial needs. The most common are current deposits, meant for everyday transactions; savings deposits, which promote saving habits while providing moderate interest; and term deposits, or fixed deposits, which offer higher interest rates but restrict fund withdrawal for a specified period.

How Banks Handle Deposits

How do banks adeptly handle the myriad of deposits they hold? Expertly, they employ resources to manage liquidity, ensuring the appropriate mix of short and long-term deposits. They also encash deposits when clients request withdrawals and preserve a reserve ratio as dictated by central banking regulations.

Banking Loans

Retrace your steps towards another pivotal aspect of banking – loans. These borrowed funds shape businesses, sculpt industries and often, build homes.

Definition of Loans

In essence, loans are amounts lent to customers with an agreement that they will be repaid over time with interest. They are a fundamental source of bank revenue.

Types of Loans

In the vast sea of lending, banks offer an array of loans – personal loans for your immediate needs, home loans for your dream abode, educational loans that support your scholastic aspirations, and business loans that catalyze your entrepreneurial ventures.

The Mechanism of Lending in Banks

In the orchestration of lending, banks cautiously assess your creditworthiness, your ability to repay before extending a loan. Additionally, they earmark a percentage of their total deposits as reserve, offering the rest as loans.

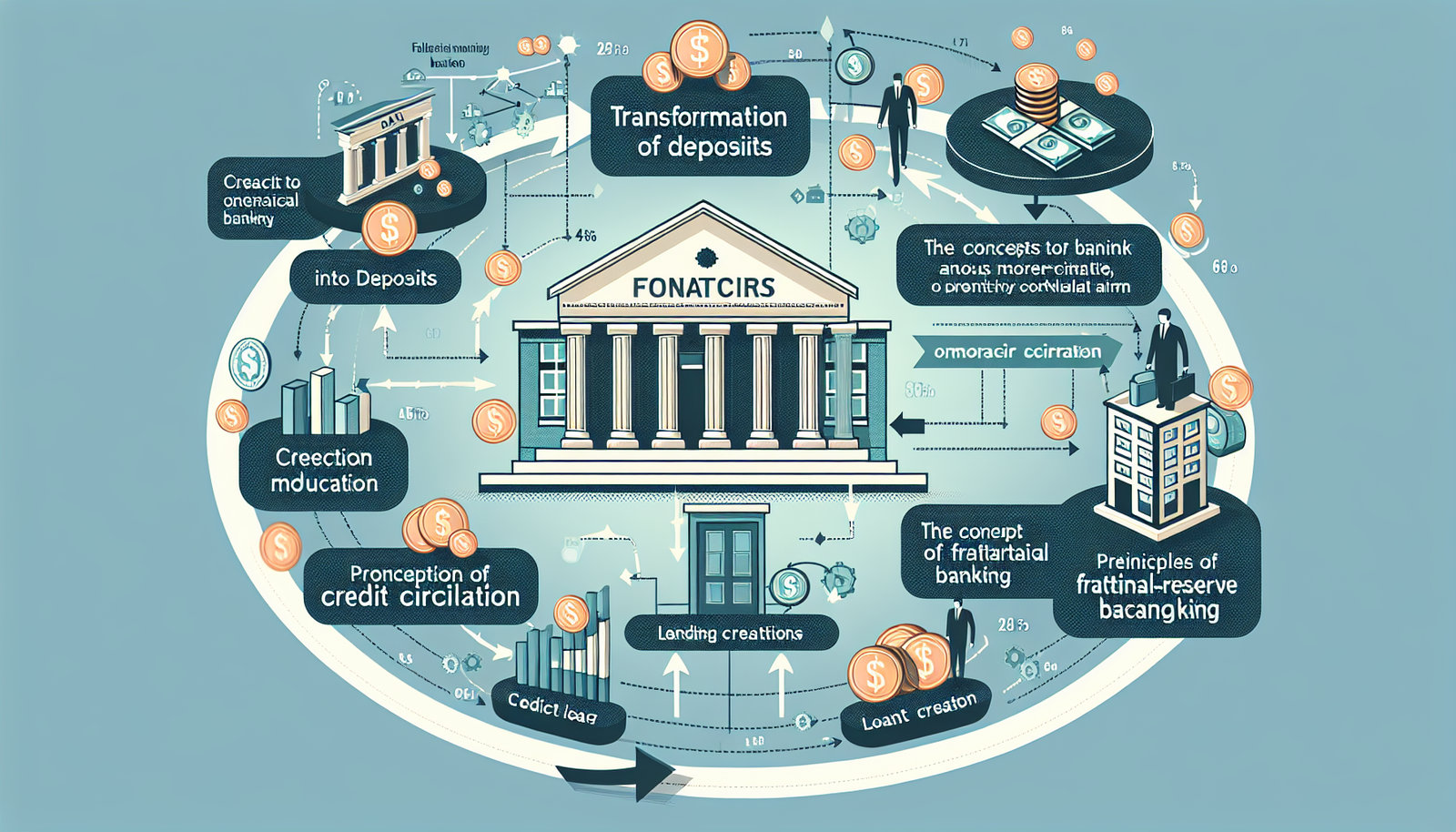

Concept of Fractional Reserve Banking

Explanation of Fractional Reserve Banking

As you traverse through the banking system, you come upon the Fractional Reserve Banking aspect. It allows banks to hold a certain percentage of deposits and lend the balance, thus enabling money creation in the economy.

Effect of Fractional Reserve Banking on Deposits and Loans

This concept profoundly impacts deposits and loans. It magnifies the money supply as every loan given out returns to the bank as a deposit, which in turn can be loaned again creating a cycle of money creation. Meanwhile, customers can freely withdraw their deposits, requiring banks to maintain sufficient reserve.

How Banks Create Money

Money Creation through Loans

In the magical world of banking, money gets created through loans. Every loan given becomes a deposit, thus leading to an increase in the total amount of money in the system.

Multiplier Effect in Banking

This phenomenon, like an echo, amplifies in the economy due to the multiplier effect. With each lending and deposit cycle, the amount of money circulating magnifies, expanding the economy’s dimensions.

Controversy on Whether Banks Loan Deposits

Overview of the Controversy

Amidst the ebb and flow of banking, a controversy arises – do banks truly loan deposits? Critics argue they create new money each time a loan is issued, contradicting the conventional belief that loans are made from existing deposits.

Key Issues in the Debate

The prime issue revolves around the question of whether banks are merely intermediaries or money creators. While traditional perspective views banks as entities loaning out deposits, the modern viewpoint perceives banks as money generators, introducing new money into the system with each loan.

Banks’ Perspective on Loaning Deposits

Banks’ View on the Concept of Loaning Deposits

Banks, maintaining their poise, assert that they loan out deposits. They affirm that while money creation occurs during the lending process, it’s primarily enabled through fractional reserve banking.

How Banks Justify Loaning Deposits

Banks justify this practice saying that loaning deposits helps allocate resources efficiently, channeling funds from savers to borrowers. Additionally, they maintain that regulatory provisions guard them against reckless lending while also promoting economic stability.

Regulations on Banks’ Loaning Deposits

Overview of Regulatory Measures

Governments and central banks around the globe have designed regulatory measures to supervise banks’ practices of loaning deposits. These regulations seek to maintain the liquidity and solvency of banks, whilst protecting depositor interests.

Key Regulatory Bodies Governing Banks’ Loaning Deposits

Key bodies like the Federal Reserve in the United States, the Bank of England in the UK, the European Central Bank in the eurozone – all have a critical role in enforcing these regulations.

Implications of Banks Loaning Deposits

Effect on Economy

Banks loaning deposits has profound implications on the economy. It propels economic activity and growth, contributes to money creation, and ultimately affects the rate of inflation and unemployment.

Impact on Customers

From a customer’s vantage point, it enables access to funds, allowing you to fulfill your dreams or meet urgent financial needs. However, such practices may also subject you to risks if the bank fails to maintain an adequate reserve, threatening the safety of your deposits.

Future of Banks’ Loaning Deposits

Trends Affecting the Practice

As you journey forward in the financial landscape, you’ll observe trends such as digital banking, peer-to-peer lending, and advanced credit assessment technologies impacting banks’ traditional practices of loaning deposits.

Banks’ Adaptation for Future Loaning Deposits

In response, banks are adapting with tighter regulations, more transparency, and better risk management practices. Coupled with innovative technologies, they continue to ensure the safety of your deposits whilst providing support to bolster economic growth.

Leave a Reply