In the realm of modern finance, the concept of a credit card holder expands beyond a mere physical accessory. The name “Credit Card Holder” epitomizes an individual’s array of financial tools, from the Milestone and Destiny credit cards boasting their attractive rewards, to the store-specific options like the American Eagle and Torrid credit cards that offer exciting in-store benefits. Big-shot corporations and smaller retailers alike, such as Big Lots and Carter’s, offer their unique credit card implementations to enhance customers engagement, loyalty and convenience. Technological advancements have further enabled the creation of extraordinary products such as the credit card generator and innovative platforms for credit card logins. This topic will explore various notions of being a credit card holder, laying out possibilities from popular options like the Goodyear, Academy, and Zales credit cards to more niche offerings like the Tomo and X1 credit cards, to help you make an informed decision.

Understanding Credit Card Basics

Defining credit card

A credit card is a payment tool that allows you to borrow money up to a certain limit in order to make purchases or withdrawals. This borrowed amount, which is known as credit, is subject to interest charges if you do not pay it back within your billing cycle.

Exploring credit card features

Credit cards come packed with a range of features such as reward programs, insurance covers, and balance transfers. They may also offer benefits such as cash back on purchases, airline miles, or points towards merchandise or travel. The exact features will vary between different card issuers and card types.

Understanding credit card billing cycle

The credit card billing cycle is the period of time between billings, which typically lasts from 21 to 45 days, depending on the card issuer. During this time, any purchases, credits, and fees are posted to your account. At the end of the cycle, you will be issued a statement that outlines the transactions made during that period, as well as the total amount owed.

Differentiating Types of Credit Cards

Detailing secured credit cards

Secured credit cards are typically offered to individuals with poor or no credit history. These cards require a cash deposit as collateral, which typically serves as your credit limit. Regularly making payments on time with a secured card can help improve your credit score over time.

Elaborating on student credit cards

Student credit cards are designed for college students. They usually offer low credit limits to help students manage their spending. Some student credit cards also offer educational resources about credit as well as rewards for good grades.

Defining business credit cards

Business credit cards are designed for business use. They offer benefits such as rewards on business-related purchases, expense management tools, and the ability to have multiple cards linked to the same account.

Understanding general purpose credit cards

General purpose credit cards, such as Visa or MasterCard, are credit cards that can be used anywhere that card’s network is accepted. These cards often have more flexible terms and more options for rewards compared to store-specific cards.

Understanding Credit Card Issuers

Defining credit card issuers

Credit card issuers are financial institutions that provide credit cards to consumers and businesses. Examples of credit card issuers include banks, credit unions, and financial services corporations.

Difference between credit card issuers and networks

While credit card issuers are the financial institutions that provide the credit cards, networks such as Visa, American Express, or MasterCard, are responsible for processing credit card transactions. Therefore, although your card might be issued by a bank such as Chase, the transactions might be processed through the Visa network.

Role of credit card issuers

Credit card issuers are responsible for setting terms for the credit cards including the APR, fees, and credit limit. They also manage the customer service aspect of credit card ownership, including billing inquiries and dispute resolution.

Exploring Specific Credit Cards

Examining the Merrick credit card

The Merrick credit card is a secured credit card designed primarily for individuals with poor or limited credit history. This card offers regular credit limit increase opportunities which can potentially help in building a better credit score.

Reviewing the Goodyear credit card

The Goodyear credit card, issued by Citibank, offers various discounts and promotional financing on Goodyear or Dunlop tires. It is a store card, which means it can only be used at Goodyear locations.

Breakdown of the BJ’s credit card

The BJ’s credit card, also known as the BJ’s Perks Mastercard, offers rewards on most BJ’s purchases. It includes benefits such as cash back on BJ’s store purchases, gas, dining out, and all other purchases.

Understanding the PNC credit card

The PNC credit card includes a range of offerings from cash back, travel rewards, and balance transfer cards. PNC cardholders also enjoy a variety of perks including access to PNC ATMs, online banking, and PNC’s mobile app.

Credit Card Payment Processes

Understanding how to make payments

Credit card payments can usually be made online, by check, or over the phone. You will need to provide your account number, as well as the amount you wish to pay.

Exploring payment options such as online or by check

Making credit card payments online is a popular option due to its convenience. You can usually opt for manual payments or set up auto-pay to ensure you never miss a payment. Alternatively, you can mail a check to the credit card issuer to make a payment.

Tackling late payment implications

Late payments can have a negative impact on your credit score and may result in late payment fees or higher interest rates. It’s important to always pay your credit card bill on time to avoid these penalties and protect your credit score.

Understanding Credit Card Logins

Walking through credit card online management

Most credit card issuers provide an online portal or mobile app where you can login to manage your account. This often includes viewing your balance, tracking your spending, paying your bill, and more.

Troubleshooting common login issues

Common login issues can include forgotten usernames or passwords, or problems with the website or app. Most online portals and apps provide options for resetting your username or password, and contacting customer service can help resolve any additional issues you may encounter.

Exploring mobile app opportunities for credit card management

Many issuers offer mobile apps where you can manage your credit card account. This can often be more convenient than logging into the website, as you can easily check your account on the go.

Credit Card Holder Responsibilities

Outlining cardholder duties

As a credit card holder, you are responsible for making timely payments, handling the card securely to prevent unauthorized use, and immediately reporting any instances of fraud or theft. Additionally, you also need to manage your spending to avoid going over your credit limit and accruing unnecessary debt.

Understanding credit card terms and conditions

It is essential to understand the terms and conditions of your credit card agreement, which include details about the interest rate, annual fee, late payment fee and other charges. This understanding will help you avoid unexpected costs.

Importance of maintaining good credit history

A good credit history allows easier access to loans and credit cards with better terms. By consistently making timely payments and keeping your credit utilization low, you can maintain a good credit history.

Understanding Credit Card Pre-approval

Defining credit card pre-approval

Credit card pre-approval indicates that you meet a credit card issuer’s initial criteria for a card. It’s not a guarantee of approval, but it can give you a good indication of your chances.

Exploring pre-approval process with Chase

Chase may send you pre-approval offers based on a review of your credit history. You can also check for pre-approval on Chase’s website. Again, pre-approval does not guarantee final approval.

Understanding impacts of pre-approval on credit score

Generally, pre-approval inquiries are considered soft inquiries and do not affect your credit score. However, once you decide to apply for a credit card, a hard inquiry that could impact your credit score will be performed.

Detailing Credit Card Generators

Defining credit card generator

A credit card generator is a tool that creates credit card numbers and details that can be used for online testing and verification purposes. These card numbers are random and do not carry any real value.

Detailing use cases for credit card generators

Credit card generators are often used by software developers for testing payment systems to ensure they are working correctly before they are put into use.

Discussing the legality and risks of using a credit card generator

While credit card generators can be used legally for testing purposes, they should never be used for fraudulent activities. Misusing these tools for illegal activities can result in criminal charges.

Understanding the Role of a Credit Card Holder

Defining the term ‘credit card holder’

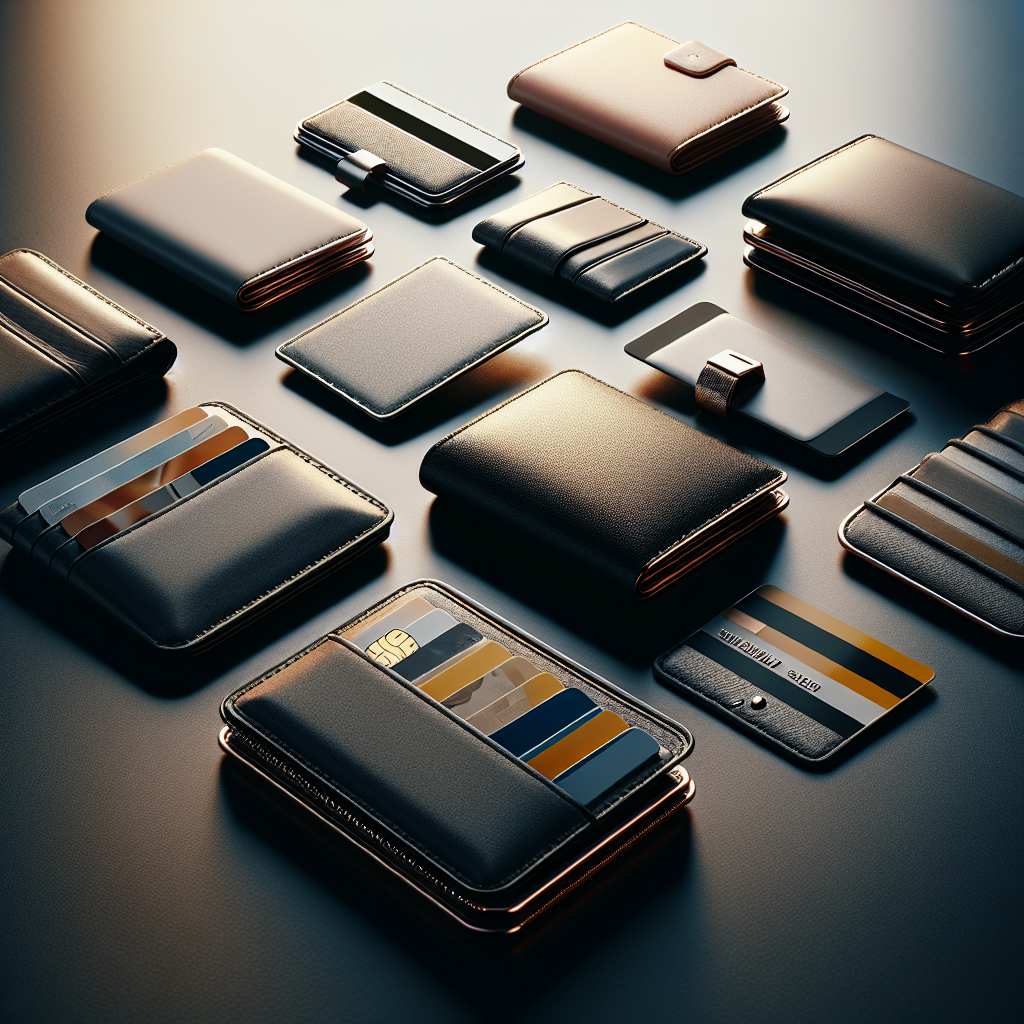

A credit card holder can refer to two things – the individual who owns a credit card or a physical case used to carry and protect credit cards.

Detailing the functions of a credit card holder

As a physical case, a credit card holder’s main function is to protect the card from physical damage and to keep it secure. Some credit card holders are designed to protect your card’s information from being stolen by RFID readers.

Discussing the optimum usage of a credit card holder for card safety

Using a credit card holder not only prevents your cards from getting damaged but also helps you organize your cards and prevent loss. When selecting a credit card holder, consider ones with RFID protection to prevent your information from being stolen.

Leave a Reply