As you trace the lines of your well-earned cash or admire the sleek silhouette of your debit card, have you ever stopped to marvel at the extraordinary journey of possibilities that money carries? “10 Uses of Money” opens up a world beyond the simple act of buying and selling, illuminating ten ways this potent tool can be wielded. From enhancing your education to developing communities, and even as an instrument of influence, money proves its worth beyond the obvious. Brace yourself for an enlightening exploration of the power you hold in your wallet.

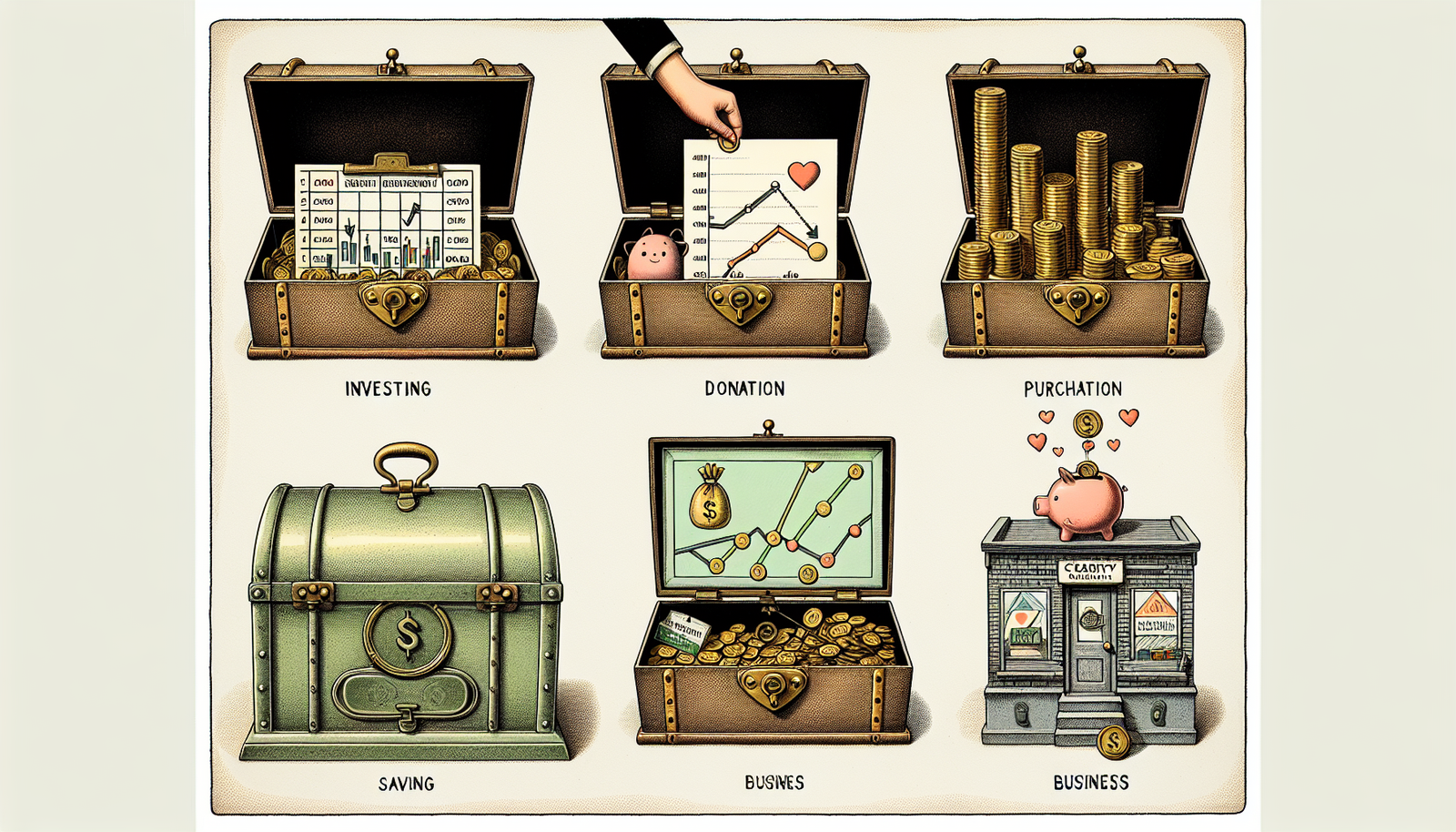

Purchasing Goods and Services

Money is a lifeline for everyone; it makes the world go round. More than the possession of wealth, it’s all about the power to purchase goods and services. With money, you can explore an exchange of items that satiate your necessities and wants.

Understanding the exchange value of money

Money mirrors value. Every product or service has a price label, representing a certain portion of your money. This portion is the ‘exchange value of money.’ It allows you to purchase and enjoy what you want. The exchange value of money assures a transaction system and barter system balance where everyone gets the equivalent value, whether a buyer or a seller.

Effects of supply and demand on the purchasing power

Your purchasing power derives from supply and demand. When the supply is extensive and demand is low, prices decrease, giving your money more purchasing power. Conversely, when supply is limited and demand is high, prices rise, and your money’s purchasing power diminishes. Understanding this economic principle helps you make wise purchasing decisions.

The role of money in global trade

Money is a ubiquitous language in global trade. It represents a nation’s purchasing power and economic strength. It ensures the smooth operation of the international market and facilitates trade relationships between countries. With money, you can buy goods from across the globe, contributing to global consumerism.

Saving and Investment

Saving and investing are two pillars of financial wisdom. They ensure personal financial stability and help to generate wealth.

Importance of saving money for future

Saving money is like packing your parachute for unexpected falls. It creates a financial safety net for future uncertainties or emergencies. Moreover, having saved money means you can invest in opportunities that arise, transforming your saved money into more money.

Tips for effective investment

Investment is a proven way to multiply your money. Buy stocks, invest in real estate, start a business; the possibilities are endless. However, it’s crucial to do thorough market research, stay vigilant to market fluctuations, diversify your investments, and take calculated risks.

How inflation affects the value of savings

Inflation is the nemesis of your savings. It erodes the purchasing power of your money. When prices increase, your saved money buys less than before, essentially lowering its value. Incorporating investment strategies that combat inflation is crucial to preserve the value of your savings.

Expressing Prices

Money serves as a standard measure for expressing prices – it’s a language we all understand.

Understanding price indicators

Price indicators signify the monetary value of goods and services. Such a system is essential as it allows for a standard, measurable valuation that aids in making informed purchasing decisions. Remember, prices are dynamic and can rise or fall depending on numerous internal and external factors.

The impact of money on pricing

The availability of money within an economy can directly impact pricing. If there’s a lot of money within an economy (inflation), prices of goods and services tend to rise. Conversely, less money circulation (deflation) can lead to a decrease in prices.

How prices affect money demand

Prices and money demand share a strong relationship. When prices rise, you need more money to meet your expenses, leading to high money demand. Conversely, price drops lead to reduced money demand. It all contributes to the grand circle of economic flow.

Paying Debts

Debts can sometimes be a financial strategy or a burden. Either way, managing money is pivotal in tackling debts.

The concept of credit and debt

Borrowing money or goods now with the promise of repaying in the future is the fundamental concept of credit and debt. Credit is a powerful tool that can enhance your lifestyle. However, it can become a tight grip of debt if not wisely handled.

Role of money in financial markets

Money is the core propellant of financial markets. Lenders lend money to borrowers who need it, creating a market of debts. Money plays a pivotal role in dictating interest rates, borrowing costs, and return on investments in these markets.

Implications of unpaid debts

Unpaid debts can turn your financial world upside down. It affects your credit score, may lead to legal actions, increases your financial liabilities with accumulating interest, and can lead to mental stress. Therefore, having a clear plan of debt repayment is essential.

Charitable Giving

Money and philanthropy are two sides of the same coin. Charitable giving is about sharing your monetary resources with those who need them the most.

Philanthropy and its role in society

Philanthropy bridges societal disparities. It provides resources for social change, fuels humanitarian efforts, and aids in community development. By sharing a part of your financial assets, you contribute to the betterment of society.

Tax benefits of charitable giving

Giving can be receiving. Charitable giving can provide you with tax benefits, depending on your location. Governments often provide tax reliefs or deductions on charity to encourage a culture of giving. Always consult a tax consultant to understand how you can benefit from your acts of charitable giving.

Choosing a cause to support

Align your money with your heart. Find a cause that resonates with you, research about it, verify its legitimacy and start giving. Your money can make a world of difference there.

Gift Giving

Money has an inevitable role in expressing love and maintaining relationships too.

Role of money in social relationships

Money allows you to express your love, respect, and value for the people in your life. Gifts are an expression of these feelings. Monetary or otherwise, gifts can strengthen your social relationships.

Cultural significance of monetary gifts

In many cultures, money holds ceremonial and symbolic significance. Monetary gifts are considered a gesture of goodwill and blessing. However, the ‘giving’ should never become a burden or competition. It’s always the sentiment, not the amount that counts.

Understanding gift tax

Gift tax is a tax on money or property that one person gives to another while receiving nothing or less than full value in return. Not all gifts are taxable; it depends on the value of the gift and tax laws of your region. Understanding gift taxes can help you plan your gifts better.

Insurance and Security

In life’s uncertain roller-coaster, money can be your safety harness. It provides the means for insurance and security.

Role of money in risk management

Insurance is a risk management tool that involves regular payment of money (premium) to avoid potential future financial losses. Investing money in insurance policies can protect you against financial risks associated with health, life, property or even business.

Understanding insurance policies

Insurance policies are contracts of coverage. They promise financial compensation for specific losses in return for regular premium payments. Understanding your insurance policy includes knowing your coverage, your premiums, your obligations, the term of policy, and the claim process.

Building financial security

Money is an integral part to building financial security. By establishing savings, investing wisely, procuring appropriate insurances, and planning for retirement, you can build a secure financial haven for you and your family.

Education and Skill Development

Money and education are tied in a loop. One can be the path to another, invigorating financial and personal development hand in hand.

Investing in education and its returns

Investing in education is essentially investing in yourself. It broadens your skillset, opens opportunities for better jobs, and in turn, could lead to a higher income. An educated society is also a critical factor for a country’s socio-economic development.

Financial implications of career development

Career development and financial success share a parallel path. With more skills and higher job roles, comes a higher income. However, this might involve costs for additional qualifications, certifications, and courses. Thus, it’s essential to consider these financial implications in your career development plan.

Understanding student loans and scholarships

Rising education costs have made student loans a common financial strategy. They enable you to pursue your academic dreams now and repay later when you start earning. Scholarships, on the other hand, are a non-refundable financial help based on academic or other achievements. Understanding the pros, cons, terms, and conditions of student loans and scholarships can guide you in making the best education financing decision.

Travel and Leisure

Money allows you to weave beautiful memories through travel and leisure activities.

Financial planning for travel

Traveling is a rewarding experience, but it involves significant financial planning. It includes understanding travel costs, saving money, planning the budget, making smart spending choices, and being prepared for emergencies. Good financial planning ensures stress-free vacations and memories worth every penny.

Understanding the cost of leisure activities

Leisure activities are essential for a balanced and joyful life. Whether it’s a movie night, a guitar lesson, a yoga class, or a fine dining experience, all leisure activities have a cost. Knowing and considering these costs in your budget allows you to enjoy without financial worries.

Should we save or spend on experiences?

To save or to spend, the quandary is perpetual. While saving is crucial for future financial stability, spending on experiences contributes to present happiness and life satisfaction. It’s all about striking a balance. After all, as Ralph Waldo Emerson quoted, “Money often costs too much.”

Healthcare

Health is true wealth. And, money plays an integral role in maintaining it.

Understanding healthcare costs

From doctor visits, treatments, medicines, to health insurance premiums, healthcare can be expensive. An understanding of these costs is pivotal in planning a balanced healthcare strategy. It allows you to be prepared and avoid potential financial distress associated with health issues.

Role of money in preventive healthcare

Preventive healthcare involves regular check-ups, vaccinations, health screenings, and healthy lifestyle choices to prevent diseases. While it may involve a regular cost, it saves you from potential high healthcare costs and health troubles in the longer run.

Financial planning for medical emergencies

Life is unpredictable, and medical emergencies can knock on the door anytime. Having financial protection strategies like emergency savings, health insurance, and critical illness covers can ensure money isn’t a stressor in tough times. Effective financial planning can help you handle medical emergencies without getting drowned in debts.

In conclusion, the role of money in our lives is undeniable. It’s not just about amassing wealth, but how we manage, save, and spend it. Ultimately, money’s purpose is to improve our conditions, contribute to society and lead a fulfilled and balanced life. Through understanding the many uses and managing it wisely, we can ensure that money serves its purpose well.

Comments (13)

Nicklaus Kuhnsays:

01/29/2024 at 4:10 PMTikTok’ta takipçi, beğeni ve izlenme satın alma hizmetleri sunan takiple.com.tr, kullanıcıların platformdaki varlığını güçlendirmelerine ve içeriklerini daha fazla kişiye ulaştırmalarına yardımcı olabilir.

Snapchat Takipçisays:

02/05/2024 at 1:57 PMGoogle yorum satın almak için en güvenilir adres burası. Google yorum satın al ve işletmenizi daha görünür hale getirin.

Verla Rausays:

02/11/2024 at 2:54 AMI just could not leave your web site before suggesting that I really enjoyed the standard information a person supply to your visitors Is gonna be again steadily in order to check up on new posts

Cristal Kundesays:

02/14/2024 at 3:22 AMHey there You have done a fantastic job I will certainly digg it and personally recommend to my friends Im confident theyll be benefited from this site

Ian Kuphalsays:

02/17/2024 at 9:15 AMyou are in reality a just right webmaster The site loading velocity is incredible It seems that you are doing any unique trick In addition The contents are masterwork you have performed a wonderful task on this topic

puravive reviewssays:

02/20/2024 at 5:34 PMNice blog here Also your site loads up very fast What host are you using Can I get your affiliate link to your host I wish my site loaded up as quickly as yours lol

fitspresso reviewssays:

02/22/2024 at 2:41 PMWonderful beat I wish to apprentice while you amend your web site how could i subscribe for a blog web site The account aided me a acceptable deal I had been a little bit acquainted of this your broadcast provided bright clear idea

aeroslimsays:

02/22/2024 at 7:11 PMI loved as much as youll receive carried out right here The sketch is tasteful your authored material stylish nonetheless you command get bought an nervousness over that you wish be delivering the following unwell unquestionably come more formerly again since exactly the same nearly a lot often inside case you shield this hike

Kiana Stromansays:

02/27/2024 at 2:45 PMElevate your website’s quality with Toolifygo! Our suite of SEO, text, and image tools is designed to enhance every aspect of your online presence. Make your site irresistible to both search engines and audiences. Experience the uplift with Toolifygo today.

puravive reviewssays:

02/27/2024 at 11:50 PMThis page is phenomenal. The splendid substance exhibits the essayist’s commitment. I’m overwhelmed and expect more such unfathomable posts.

먹튀검증says:

02/28/2024 at 5:14 PM꽁타는 국내 최대 규모의 방대한 정보를 보유하고 있는 먹튀 검증 커뮤니티 입니다.

꽁머니 토토사이트says:

04/04/2024 at 9:54 AM✔️꽁타✔️ggongta.com,꽁머니 커뮤니티,꽁머니이벤트 꽁머니 커뮤니티 Simply wish to say your article is as amazing The clearness in your post is just nice and i could assume youre an expert on this subject Well with your permission let me to grab your feed to keep updated with forthcoming post Thanks a million and please carry on the gratifying work

Sylvester Borersays:

04/07/2024 at 4:45 AMYou consistently deliver high-quality content.