Opening your eyes to the intricate world of economics, consider your own involvement, for instance when you slide a piece of plastic across a countertop or hand over a few wrinkled bills. Your very actions are sowing the seeds of monetary transaction, which is a pivotal concept in the realm of economics. This article; “What is Money in Economics”, will take you on a thrilling journey where each stop sign introduces you to a new facet of the seemingly simple idea of money, its role, functions and how it drives economies worldwide. This intriguing excavation into economics promises to alter your perception of that little green paper bill sitting in your wallet.

Understanding the Concept of Money in Economics

Imagine living in a world without money, where trade goes back to the traditional barter system. The limitations become glaringly apparent. This is why money, in all its form and evolution, is a central concept in economics, acting as the lifeblood in an economic structure.

Definition and meaning of money in economics

Money, at its simplest, is anything that people in an economy agree to use for the purpose of buying and selling goods and services. It is a medium of exchange that eliminates the need for immediate reciprocity between traders.

The role and significance of money in economic activities

Think of money as a facilitator. It allows economic activities to take place efficiently. It simplifies the process of trading, setting values for goods and services, and lets you save wealth for future use. It’s like a catalyst, quickening and easing the flow of transactions in an economy.

Key concepts associated with money

Key to understanding money are the concepts of liquidity, divisibility, homogeneous nature, and limited supply. These elements contribute to its stability and usability in an economy, making it a universally recognized item for trade.

Historical Development of Money

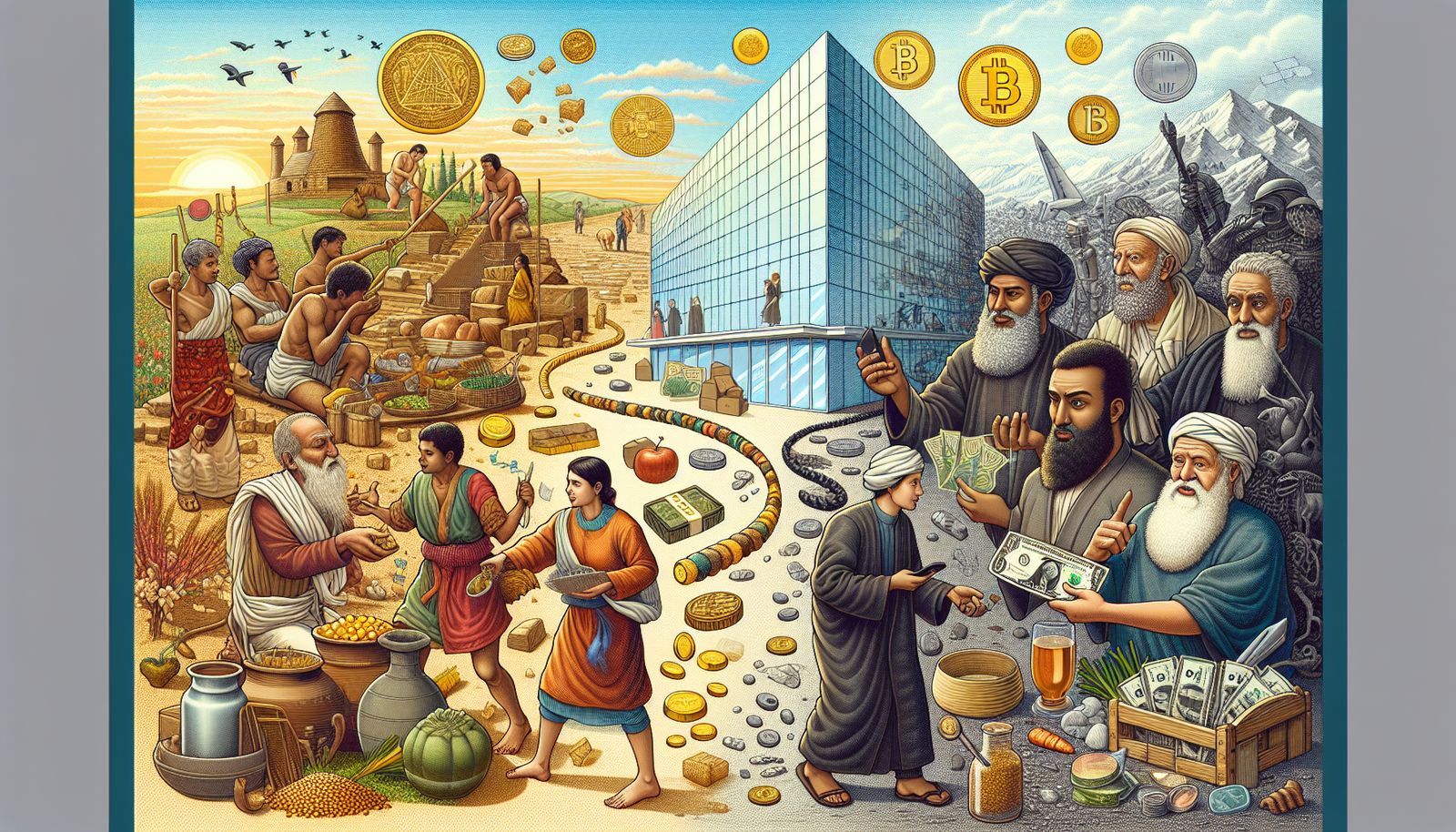

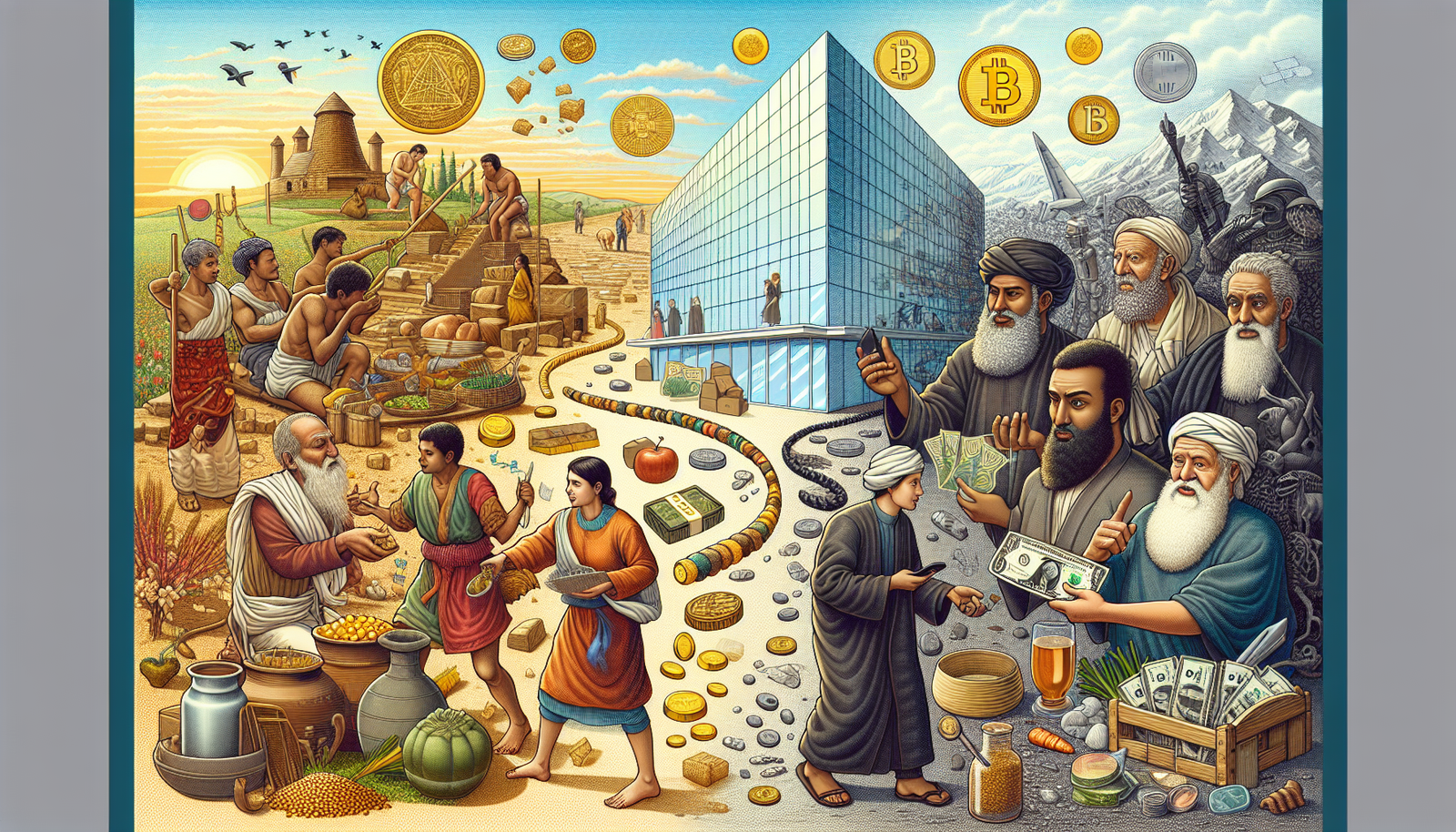

Sometimes, to look forward, it’s equally important to look back. The evolution of money shows the ingenuity of humans in finding solutions to complex problems.

Barter system and its limitations

Before money, there was barter, a simple trade of goods and services for other goods and services. Barter had its problems. What if you had crops but needed a cow? Finding someone who wants your crops and has a cow can be tough. Also, barter lacked divisibility. What if the trade required half a cow?

Transition from barter system to monetary system

The limitations of barter led to establishing a common medium of exchange – money. Cattle, shells, metals, and other goods served as early forms of money. The transition from the barter to monetary system improved economic efficiency by leaps and bounds.

Evolution of money: From commodity money to digital money

Over time, money evolved. It moved from commodities (cattle, shells) to metallic (coins) to paper (bills) and finally towards digital forms (credit cards, cryptocurrencies). This evolution not only widened the reach of money but also eased the way transactions occurred.

Types of Money

Commodity money

Commodity money is the oldest form of money. It has an intrinsic value. Gold coins, for example, were valuable in themselves and were used as money.

Representative money

Representative money is not valuable per se, but represents a promise to pay a certain commodity. For instance, a bill is a promise that you can exchange it for its face value in gold or silver from the banks.

Fiat money

Unlike commodity or representative, fiat money doesn’t have intrinsic value. Its value comes from the trust and acceptance by the people in a country that it can be used for exchange. The currencies we use daily, like the Dollar or the Euro, are examples of fiat money.

Digital money and cryptocurrency

We’ve gone one step further with digital money. It exists only in electronic form. It includes cryptocurrencies like Bitcoin, which work on a technology called blockchain, and are decentralized, unlike fiat currencies.

Characteristics of Money

Remember that not everything can be used as money. Certain characteristics make money effective.

Divisibility

Money must be divisible, meaning it can be broken down into smaller units of value. Imagine if you could not break a $10 note into smaller coins!

Portability

You need to be able to easily carry money around for transactions.

Durability

Money needs to last. If it withers away easily, it would not be practical to use it.

Uniformity

Every unit of money needs to look the same. You can’t be playing guessing games about whether what you received was money or not!

Limited supply

Most importantly, money needs to have a limited supply. If there is too much money in circulation, it will lose its value.

Functions of Money

Money wears many hats. It’s not just for buying and selling goods.

Medium of exchange

Primarily, money provides an intermediary substance for trade, eliminating the need for a double coincidence of wants present in the barter system.

Store of value

With money, you can measure and store wealth.

Measure of value

Money provides a benchmark to set prices or value of all goods and services.

Standard of deferred payment

Money lets you buy now and pay later. Debts are measurable and payable because of money.

The Money Supply and Monetary Policy

Understanding money supply

How much money circulates in an economy? That’s the money supply, which can affect economic variables like inflation and unemployment.

Control of money supply

Controlling the money supply is a tricky balancing act. Too much money can cause inflation. Too little may lead to economic stagnation.

Instruments of Monetary policy

Central banks, like the Federal Reserve, use tools such as open market operations, the discount rate, and reserve requirements to control the money supply.

Impact of monetary policy on economy

Monetary policy impacts the economy in significant ways. It influences interest rates, inflation, and economic growth.

Inflation, Deflation, and the Value of Money

Understanding inflation and deflation

Inflation is when the cost of goods and services rises over time. Deflation is the opposite when prices decline. Both can significantly impact the economy.

Impact of inflation and deflation on the value of money

Inflation reduces the value of money since you need more of it to buy the same goods. Deflation, conversely, increases the value of money.

Measures to control inflation and deflation

Control mechanisms include fiscal policies like maintaining a healthy balance of supply and demand, or monetary policies like adjusting interest rates.

Money and Banking

Role of banks in the creation of money

Banks don’t just hold money — they actually create it through making loans. In fact, most of the money in the economy is created by banks.

Banking system and its impact on the economy

Banking systems have colossal impacts on a nation’s economy. They help in the circulation of money, providing credit, and ensuring economic stability.

Modern challenges in banking

Banks today are navigating through digital disruption, changing consumption patterns, evolving regulatory landscape, and security threats.

Money in International Trade

Role of money in international trade

Money acts as a universal measure of value in international trade. It aids in balancing trade between nations and facilitates smooth international transactions.

Exchange rates and their influence on international trade

Exchange rates measure the value of one country’s currency against another’s. Significant fluctuations can impact cross-border trade.

Balance of payments and international monetary systems

Balance of payments records a nation’s transaction with others. A positive balance usually indicates economic health.

Future of Money: Digital Currency and Beyond

The rise of digital currencies

Digital currencies reveal an exciting and challenging frontier in the world of finance. They are revolutionizing how we perceive and utilize money.

Impact of digital currencies on the global economy

Digital currencies can potentially increase global financial inclusivity, reduce transaction costs, and speed up transfers.

Potential future developments in money

We stand at the precipice of a new era. Whether it’s advanced digital currencies, digital wallets, or decentralized finance – the future of money is robust with possibilities.