I’m thrilled to share with you an exclusive look at the titans of the global banking industry. This article explores the top five banks in the world, ranked according to their staggering asset size. You will gain insight into these financial powerhouses, understanding not only their comprehensive assets, but also their impact on the global economy and positions in the financial market. “Top 5 Banks In The World By Asset Size” is more than just a simple rank list; it’s your guide to the true giants of the banking world.

Overview of the Top 5 Banks in The World By Asset Size

Brief overview

In this dynamic world of high finance, banks play a crucial role, serving as pillars of the global economy. The top-tier banks are powerful entities, influencing markets and directly impacting significant economic and financial activities. This article will take you on a tour of the top five banks in the world, ranked by asset size. These include the Industrial and Commercial Bank of China, China Construction Bank Corporation, Agricultural Bank of China, Bank of China, and the Mitsubishi UFJ Financial Group.

Criteria for ranking: Asset size

The primary yardstick used for ranking these banks is the asset size. In the banking industry, an asset refers to anything the bank owns, including loans, securities, and physical properties. The asset size allows us to gather a comprehensive picture of the bank’s size and the extent of its operations.

Importance of asset size in banking

Asset size is a critical indicator of a bank’s health. A large asset base signifies strength, potential for generating profit, and resilience against market fluctuations and economic downturns. It also provides a measure of the bank’s capacity to weather financial crises or lending downturns.

Bank #1: Industrial and Commercial Bank of China

Overview and history

As our journey begins, we first land in China, presented with the Industrial and Commercial Bank of China (ICBC). Founded in 1984, ICBC is not only China’s largest bank but also tops the list of the world’s largest banks by asset size.

Asset size and ranking

ICBC proudly sits atop this list with an estimated asset size of over $4 trillion. This staggering figure portrays the vast scale and significance of ICBC’s operations, placing it solidly in the top position.

Key services and operations

ICBC’s operations span multiple fields, including commercial banking, investment banking, and asset management. The bank offers a myriad of services like deposits, loans, foreign exchange transactions, fund underwriting, and trust services.

Major achievements and recognitions

Throughout its history, ICBC has earned several remarkable recognitions. It has been consistently listed in the Fortune Global 500 list, asserting its international standing. It has also garnered business performance awards due to its robust growth, contributions, and solid asset base.

Bank #2: China Construction Bank Corporation

Overview and history

Moving ahead, we encounter the China Construction Bank Corporation (CCBC). Established in 1954 as the People’s Construction Bank of China, CCBC has grown phenomenally over the years to become one of the world’s largest banks.

Asset size and ranking

With an impressive asset base exceeding $3 trillion, CCBC earns its spot as the second-largest bank in terms of asset size.

Key services and operations

CCBC’s operational spectrum is diverse, offering banking operations, treasury operations, and specialized business. Its services encompass corporate banking, personal banking, treasury business, and investment banking.

Major achievements and recognitions

CCBC has amassed immense recognition, landing a consistent spot among the top global banks. It has received awards for its exceptional services, and its involvement in China’s economic advancements is commendable.

Bank #3: Agricultural Bank of China

Overview and history

Next on the list is the Agricultural Bank of China (ABC). Established in 1951, ABC was initially intended to facilitate China’s agricultural development. Over time, it has diversified to offer an extensive range of banking services.

Asset size and ranking

ABC boasts an asset size of more than $3 trillion, placing it third on the list of the world’s largest banks.

Key services and operations

ABC’s portfolio includes corporate banking, retail banking, asset management, and treasury operations among others. It caters to client-groups that encompass large enterprises, small and medium-sized enterprises, and individuals.

Major achievements and recognitions

ABC’s influence reaches far and wide, and it has made its mark at a global level. It achieved significant results in its strategic transformation and received awards for the best wealth management among Chinese banks.

Bank #4: Bank of China

Overview and history

The Bank of China is next on our itinerary. Formed in 1912, it’s the oldest bank in mainland China and has played an essential role in the country’s economic growth and development.

Asset size and ranking

The Bank of China holds an asset size of over $3 trillion, making it the fourth largest bank in the world.

Key services and operations

The Bank of China offers a broad spectrum of financial products and services. It’s engaged in commercial banking, investment banking, insurance, asset management, and other financial services.

Major achievements and recognitions

Despite being over a century old, the Bank of China continues to make waves. It has consistently featured in the prestigious Fortune Global 500 list and has received numerous other accolades for its long-lasting performance and excellent service.

Bank #5: Mitsubishi UFJ Financial Group

Overview and history

Our travels finally take us to Japan, where we encounter the Mitsubishi UFJ Financial Group (MUFG). Formed in 2005, MUFG is a relatively new bank but has risen exceptionally to become the largest bank in Japan and fifth-largest in the world.

Asset size and ranking

MUFG commands an asset size upwards of $2.8 trillion, securing its spot as the fifth-largest bank globally.

Key services and operations

MUFG’s business includes commercial banking, trust banking, securities, credit cards, consumer finance, asset management, and leasing.

Major achievements and recognitions

MUFG has successfully registered its global presence ever since its induction. It has earned high ranks in several global banking and financial institutions’ listings, depicting its influence and commendable performance in the financial sector.

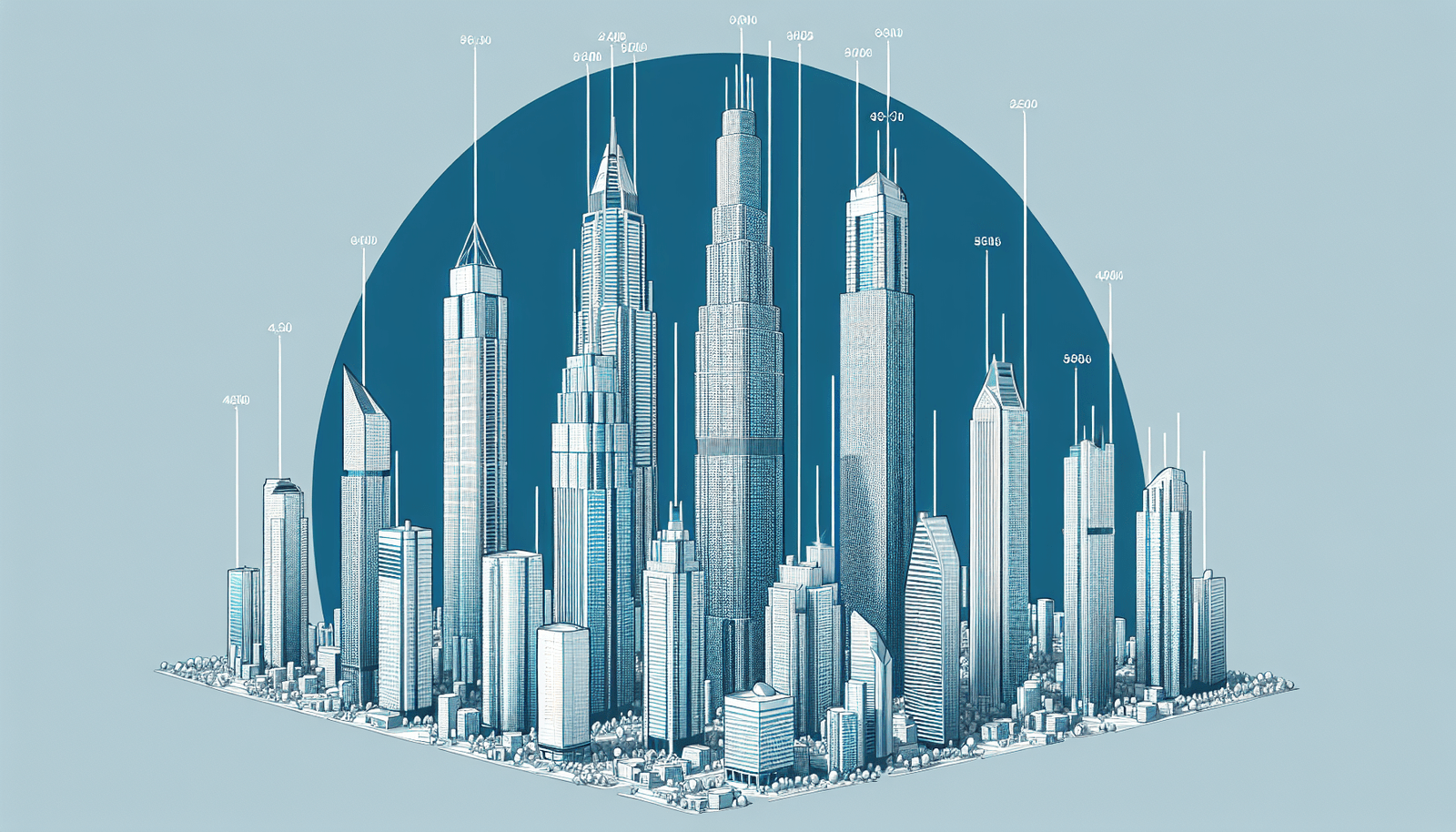

Comparison of the Top 5 Banks

Comparison of asset sizes

A comparison of their asset sizes reveals the scale at which these banks operate, with each having asset sizes of over $2 trillion. China’s dominance is clearly depicted, hosting the top four on the list.

Key differences in services and operations

While most these banks offer similar services, there are subtle differences in their operations due to their distinctive historical backgrounds and areas of specialization which ultimately sets them apart.

Financial performance comparison

In terms of financial performance, these banks have all exhibited strong resilience and robust growth, reflecting their strength and stability.

Comparison of market reach and presence

While these banks have a strong domestic presence, they have also made significant strides in extending their global footprint, commanding respect in the international banking arena.

The Role of These Banks in the Global Economy

Contribution to the economy

These banks are the lifeline of the economies they operate in, providing capital for businesses, supporting governments, and facilitating everyday transactions, thus contributing heavily to the global economy.

Market influence

Due to their massive asset size, these banks wield significant influence over global market trends and can impact economies with their lending and investment decisions.

Challenges Facing The Top 5 Banks

Economic fluctuations and uncertainties

Economic uncertainties, including changes in interest rates, volatile foreign exchange rates, geopolitical factors, and pandemics, pose a challenge to these financial giants.

Regulatory challenges

As global entities, these banks need to navigate complex regulations in various jurisdictions, which can be daunting.

Technology and digital transformation

The rapid pace of technological advancement and the rise of FinTech firms have disrupted traditional banking models and increased customer expectations, necessitating rapid adaptation.

Competitive pressure and market dynamics

Mergers and acquisitions, changing customer preferences, and greater market competition put additional pressure on these banks, compelling them to innovate continuously.

Future Prospects for the Top 5 Banks

Growth prospects

With their vast resources and unmatched scale, these banks are well-positioned to capitalize upon future growth opportunities. Anticipating trends and making strategic investments will be key.

Potential challenges and risks

Navigating economic uncertainties, evolving customer expectations, regulatory complexities, and technological challenges will be critical for these banks’ sustained success.

Strategic initiatives for future growth

These banks have adopted several strategic initiatives to ensure growth, such as tapping into emerging markets, adopting digital transformation, enhancing customer experience, and investing in sustainable practices.

Emerging trends and their impact on these banks

From a push towards sustainable financing and adoption of blockchain technology to the rise of artificial intelligence and big data in decision-making, emerging trends will drastically impact these banks.With the right strategies and proactive actions, these banks would be able to capitalize on these innovations, making them an integral part of their future success.

Phew! We have now concluded our world tour! The journey through these banking giants not only illuminates the mammoth operations they manage but also emphasizes the significant role they play in the global arena. As we advance, these banks’ strategic decisions and operations will continue to shape our global economic landscape. Thus, we should keep a keen eye on their actions and progress. Happy banking, everyone!