Unlocking Financial Efficiency: 11 Benefits of Supply Chain Financing for Banks and Insights on Essential Platforms

Understanding Supply Chain Financing Supply chain financing is a financial ecosystem designed to optimize the flow of capital within a…

13 Ways Cross-Border Payment Systems Benefit Banks and How Cross-Border Payment Settlement Works: 8 Key Insights

Introduction to Cross-Border Payment Systems Cross-border payment systems refer to the processes and mechanisms that facilitate the transfer of funds…

How SWIFT Messaging Systems Simplify International Transactions: 8 Key Features Explained

Introduction to SWIFT Messaging Systems The Society for Worldwide Interbank Financial Telecommunication, commonly referred to as SWIFT, serves as a…

5 Must-Have Features in Forex Trading Platforms for Banks: Key Benefits Explained

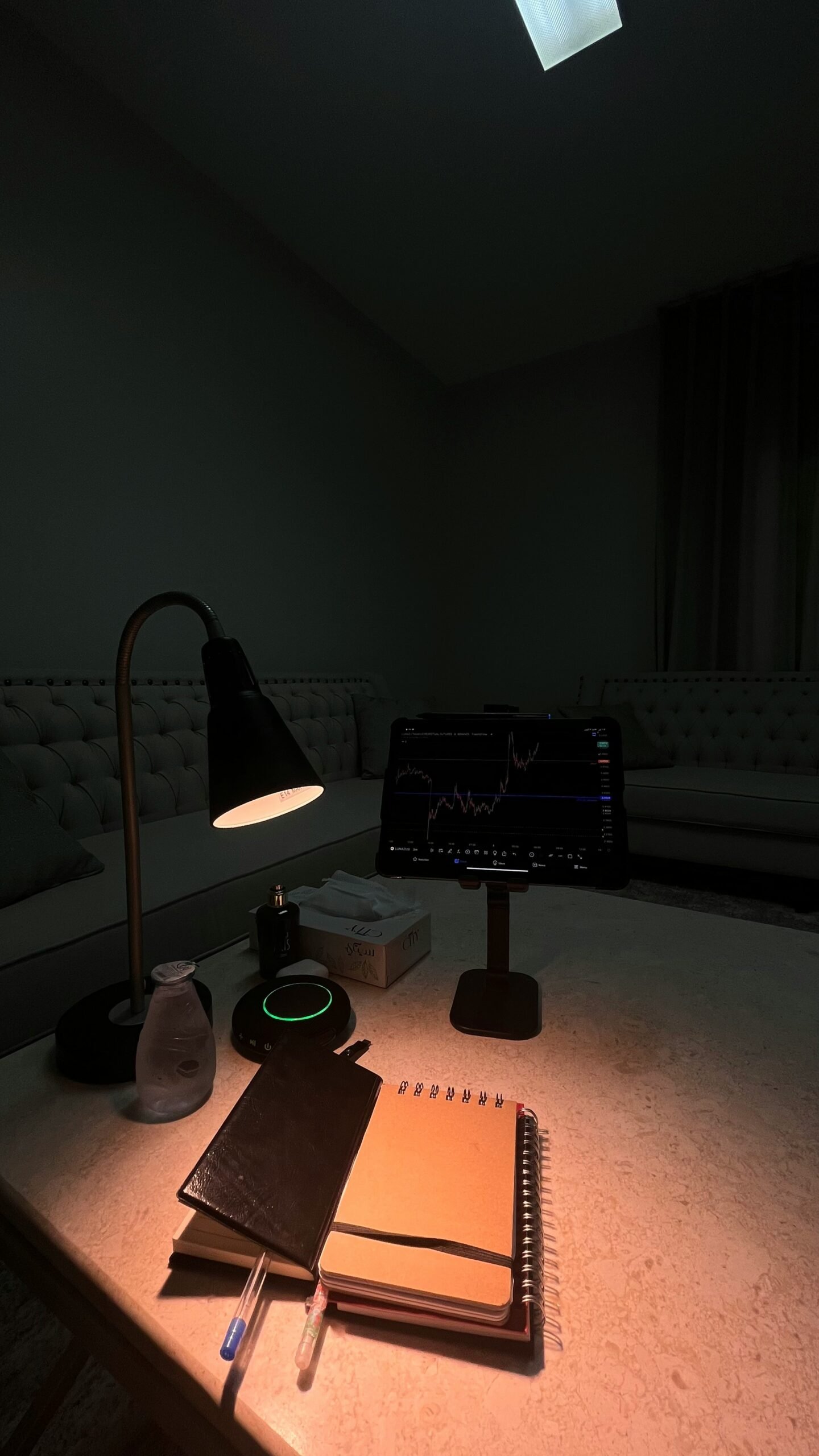

Introduction to Forex Trading Platforms Forex trading platforms serve as essential electronic systems that allow banks and financial institutions to…

Exploring 7 Major Banks’ Forex Trading Platforms: A Comprehensive Guide

Introduction to Forex Trading Foreign exchange trading, commonly known as forex trading, represents one of the most significant and active…

The Importance of Global Compliance Systems in Banking: How They Protect Financial Institutions

Introduction to Global Compliance Systems Global compliance management systems are frameworks designed to ensure that financial institutions adhere to various…

5 Benefits of Digital Signage in Banking, Branches Elevating Customer Experience

Introduction to Digital Signage in Banking Digital signage systems represent a significant advancement in the way banks communicate with their…

4 Ways Kiosk Banking Machines Enhance Customer Experience and Why They’re Gaining Popularity: 5 Insights

Introduction to Kiosk Banking Machines Kiosk banking machines are self-service automated devices that enable customers to conduct various banking transactions…

The Importance of Multilingual Support in Banking: 15 Benefits and 5 Key Insights

Introduction to Multilingual Support in Banking In an increasingly globalized society, the banking sector faces the challenge of addressing a…

The Critical Role of Cybersecurity Intelligence in Banking: 5 Key Insights

Introduction to Cybersecurity Intelligence in Banking In the rapidly evolving digital landscape, the importance of cybersecurity intelligence in banking cannot…